Month: November 2016

Staying ahead of the digital curve with real-time decisioning

Dynamics of digital

Financial institutions used to be the last candidates for change when it came to technology adoption. But over the recent past the banking sector has seen a dramatic ‘digital’ transformation given a discerning and demanding ‘digital’ generation, ferocious competition and a briskly evolving regulatory landscape.

Financial institutions used to be the last candidates for change when it came to technology adoption. But over the recent past the banking sector has seen a dramatic ‘digital’ transformation given a discerning and demanding ‘digital’ generation, ferocious competition and a briskly evolving regulatory landscape.

From a customer’s perspective, a bank that has gone digital should be able to, at a minimum, instantly provide accurate information across devices, platforms and geographies. Customers are intolerant to service downtimes and want their needs addressed promptly and efficiently almost 24/7.

From credit cards to ATM to net banking to phone banking, the bank of today provides customers with an experience that is both seamless and of superior quality.

But banks can do a lot more to stay ahead of the ‘digital’ curve.

The digital bank of tomorrow

Many ‘progressive’ banks have gradually unified their entire IT ecosystem to harness the capabilities of big data analytics.

Many ‘progressive’ banks have gradually unified their entire IT ecosystem to harness the capabilities of big data analytics.

But there’s one more vital aspect banks must know – that they virtually have the customer’s ‘aatma’ or soul with them, given the behavioral intelligence and insights already resident across their multiple systems.

A bank is the only body that has the complete and in-depth lifestyle information of customers – earnings, spending, travel locations, home ownership status, marital status, right down to monthly fuel consumption.

With the variety and depth of insights available, banks can create instant, hyper-individualized interventions using a ‘segment of one’ approach to target customers precisely for intelligent cross-sell and up-sell.

So a unified, cross-channel digital strategy that utilizes this ‘soul’ to deliver an exceptionally superior customer experience becomes essential. Combine this with real-time technology, and banks have a compelling value proposition.

The soul of true digital transformation

The soul analogy also applies perfectly in combating sophisticated financial fraud, where deviations and discrepancies can be detected and resolved ‘intelligently’ in the blink of an eye.

The soul analogy also applies perfectly in combating sophisticated financial fraud, where deviations and discrepancies can be detected and resolved ‘intelligently’ in the blink of an eye.

Given the customer insights available, the same real-time decisioning can be leveraged to instantly detect anomalies and prevent them from occurring.

A meaningful digital transformation must include the customers’ soul. The digital bank of tomorrow must articulate a strategic platform that goes beyond servicing customers flawlessly and have intelligent revenue maximization and fraud detection capabilities.

Episode 2: Blacklisted

Our new series of thrillers – produced and directed by CustomerXPs and Banking Technology – narrate the tales of the fight between the forces of good (the Clari5 analytics and anti-fraud software) and the forces of evil. Based on real events and guaranteed to keep you on the edge of your seat!

“All passengers travelling to Seattle by Southwest Airlines, WN44, are hereby informed that the flight is running 25 minutes late due to a delayed take-off at Newark. We apologise for the inconvenience and thank you for your patience and understanding.”

Tamara’s face was a picture of concentration as she looked intently at her notebook. She was working furiously on her new client pitch, having logged into the airport Wi-Fi. $25,000 rested on her slim shoulders.

Clari5 – fighting the forces of evil

She saw the FB notification from the corner of her eye. She pursed her lips and blew out her cheeks in frustration. Dammit! She was going to be late to Seanna’s birthday party tonight! Best to send her a bouquet in advance, just in case.

He watched Tamara’s reactions. He analysed her like a well-trained covert operative: “Attractive, travelling alone, and working hard on something. Uh oh, she ain’t happy with the delay bro!” So will she be giving him his “fix” for the day? Wait dude, something’s bound to… here we go! We’re in business!”

Tamara was browsing a florist shop website. She scrolled through some pretty bouquets and finally settled for a nice $30 one. “Seanna loves lilies. A nice bouquet with pink and white lilies should be good. Okay, almost done. Cool, will reach her by 7.00 pm and that should cover me even if I’m late aaaaand she’ll be delighted. Should I sign as a ‘secret admirer’? Ooooh, wouldn’t that throw her in a tizzy. Done!”

Another announcement. Time to board. Notebook shut, slipped into carry bag, mobile phone in hand, bag on shoulder, all sorted. Tamara got up from her airport lounge seat in one swift movement, and strode purposefully towards boarding gate No 4. $25,000 was up for grabs.

He had been tracking her movement online. Public Wi-Fi made it so easy. She hadn’t logged out. Most don’t, thankfully, which makes life easy for him and his troupe. Okie dokie, am in. Now let’s reset.

Clari5, the lone crusader was at work. It was doing its usual sweep of account information when it paused. Ping. Ping. Ping. Pause.

Tamara Stein.

Logged in from notebook at 10.23 am at SJC International airport.

Another log in at 10.33 am from SJC from an unknown device. (?)

Request change in Challenge Question (?)

Something amiss?

At precisely the same time when Clari5 pinged, a phone in another part of the bank rang. Josephine had a wonderful baby shower last night. Her first baby and she was so excited! She felt chirpy and happy and she was all systems go.

“Could you give me your DOB please? Thanks.

“Could you give me the details of your last transaction please?

“Could you confirm your mailing address please?

“Thank you for providing me with all the necessary details. Your request for change in mobile number is in process. It would take about 30 minutes to get it activated. Thank you, yes, sure, will do. Have a nice day.”

Josephine entered the change request in the system. Josephine hit “Enter” and the request for a change in mobile number was recorded in Clari5.

Tamara’s big mistake of not logging out from the airport Wi-Fi helped him access her credit card details. This slip would be his next “fix”. He grins evilly.

10.45am. He checks his phone. SMS text: “Thank you for your request. Your new mobile number will be updated in our records in 30 minutes. If you haven’t made the request, please call us immediately on 100-123-8897.”

30 minutes later he logs in. Beneficiary changed. Transfer of $25,000 initiated. Yes!!

Clari5 blinks. The cursor at Tamara Stein’s name seems to be digging in its heels. Is it?

Could be a possible “account takeover”.

It was time to monitor Tamara Stein’s account more closely. Time to move it to the closely monitored account (CMA) status.

Clari5 made this decision in real time. After all, more than 80% of the available account balance was to be transferred – more than the average transfer that Tamara Stein had ever requested going by past records.

It’s blocked. Clari5 has blocked the request. Funds transfer has been suspended. Text message to Tamara reads: “We have received a request for $25,000 funds transfer from your account. As a customary verification process, please present yourself in the bank with your ID proof.”

Beep. He looks at the message on his mobile. What in the name of… ? Damn! How? He’s furious.

“Hi, this is Tamara. I just got a message about a transfer of $25,000 from my account. I didn’t make any such request… Oh? Is that so? Sorry, I didn’t see the message as I was on a flight. OK, sure. Oh great. I’ll be there tomorrow morning with my ID. Thanks.”

“Happy birthday to you, happy birthday to you… ” the sounds of laughter and glasses clinking can be heard. Tamara is on top of the world. She nailed the presentation and had won the pitch. And Seanna loved the bouquet.

At the bank, the pings go off once again. Clari5 is on high alert again.

Mobile phone number 147-8976-234 is blacklisted!

Episode 2: Blacklisted

Fraud-proofing Credit Cards Intelligently

Fraud-proofing Credit Cards Intelligently

While credit cards have transformed purchase transactions, it has not been without simultaneously growing vulnerabilities.

While credit cards have transformed purchase transactions, it has not been without simultaneously growing vulnerabilities.

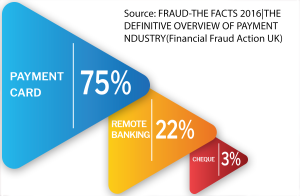

Financial fraud losses across payment cards, remote banking and cheques totalled £755 million in 2015 – a 26% jump when compared to 2014 says Financial Fraud Action UK.

It says that the rise across all fraud loss types during 2015 owes much to the growth of impersonation and deception scams, as well as sophisticated online attacks such as malware and data breaches.

Of the prevalent card-frauds, card-not-present (CNP) and payment fraud, CNP (where the card holder needn’t be present online or phone for the transaction) is the dominant form of card fraud in Europe in addition to the UK.

Payment fraud not only involves falsely creating or diverting payments; it goes to the extent of creating false accounts and scamming on a large scale. A merchant account created for a seemingly genuine organization performs transactions through the stolen credit cards.

The UK tops the highest jump in credit card fraud in Europe with an 18 percent rise resulting in £ 88 million of losses.

Increased rate of personal data compromise through data breaches was one likely cause for the jump.

Globalization and technology driving credit card fraud

The ability to contain scams is challenging given globalization. With financial organizations spreading their wings across geographies, the ‘law-of-the-land’ comes in to focus.

Each country has specific policies and laws that banks have to abide by leading to a lack of a common security cover. This leads to vulnerabilities let alone the effort involved in understanding laws, creating policies and maintaining them.

Hi-tech card fraudsters rely on technology as they look for ways to compromise customers’ personal and financial details and use that to commit frauds.

They hack into systems, run random generated bank account numbers and sometimes approach as legitimate organizations and lure information under the pretext of seeking data via email, text messages and phone calls made to seem as if they are from tax departments with threats of deportation or imprisonment.

Enter EMV and NFC

Enter EMV and NFC

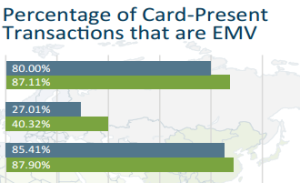

Europe was one of the early adopters of EMV (Europay, MasterCard, Visa) – a global security standard for chip-cards and the technology used to authenticate chip-card transactions.

EMV helps when the physical card is required for a transaction, protects from counterfeiting, CNP fraud continues to thrive. View the stats.

A CNN Money report features a claim by a security company having discovered a way of rewriting magnetic chip code to make it look like a chip-less card. This takes it back to the basic fraud technique of counterfeiting.

NFC allows smartphones and other devices to communicate with each other when they’re physically very close. NFC can also be present in wearable devices.

NFC has gained some movement in the US and is now being launched in Europe. According to Markets & Markets, the NFC market is expected to touch $22 billion by 2020.

While the technological advancements are definitely encouraging, they point to a fundamental question on fraud-free credit card transactions – can a channel centric (in this case, credit card only) approach be a fool-proof solution?

Solutions must rely on ‘absolute real time cross-channel intel’

While card security technology has evolved from signature cards to chip-and-pin cards and now to NFC, they will deter sophisticated, hi-tech fraudsters from inventing newer techniques in staying a step ahead.

Anti-fraud solutions cannot merely rely on a channel-centric approach. They will have to rely on advanced technologies that harness the collective wisdom about customers (factual and behavioural) already resident across a bank’s systems, pull the collective cross-channel insights at lightning speed from all channels to detect and thwart fraud intelligently in absolute real-time even as the fraud is being committed.

This gives banks an edge over fraudsters because channel-specific fraud relies only on breaching that particularly channel’s (credit cards) data.

If banks are in the know of suspect transactions while it is in progress, they can prevent the fraud from being committed in the first place instead of taking action post-incident when the deed is done.

Absolute real time anti-fraud technology coupled with continuous monitoring, stringent regulatory compliance and improved auditing are some of the primary measures banks must adopt to stay ahead of evolving fraud technology.