Month: November 2014

Cybercrime increased by 300% compared to last year

Cybercrime in India has increased by 300% since 2013 as the research by thepaypers.com indicates. Cybercrime in India has been on rise for last couple of years.

According to Mumbai police hacking, phishing and Nigerian fraud have risen to 36 in 2014 until October since 2014 from 9 registered in October 2013. 136 cases of cyber offences were registered in 2013 October compared to 418 in 2014 October.

The e-commerce in India has grown by leaps and bounds until recently. This has not only made online shopping a pleasurable experience but also made e-portals vulnerable to various cyber threats. Storage of various customer information have painted them as the next high priority target. Recent incidents of Cybercrime in United States are the clear indication of incoming danger.

In cases of Nigerian fraud, the victim receives an e-mail or SMS stating the mobile number or e-mail of the selected lucky draw in millions of United States dollars or British pounds. These e-mails or SMSs contain the contact number for claiming the money. The fraudsters also ask for meagre amount of money for clearing customs and for domestic money conversions. The fraudsters provide the account number where the specific amount has to be deposited.

In cases of phishing where the fraudsters sends an e-mail to a user falsely claiming to be an established legitimate enterprise. This fraudulent enterprise in attempts to scam the user into surrendering private information that will be used for identity theft. The e-mail directs the user to visit a website where they are asked to update personal information, such as passwords, and credit card, and bank account numbers, Cybercrime is truly a menace.

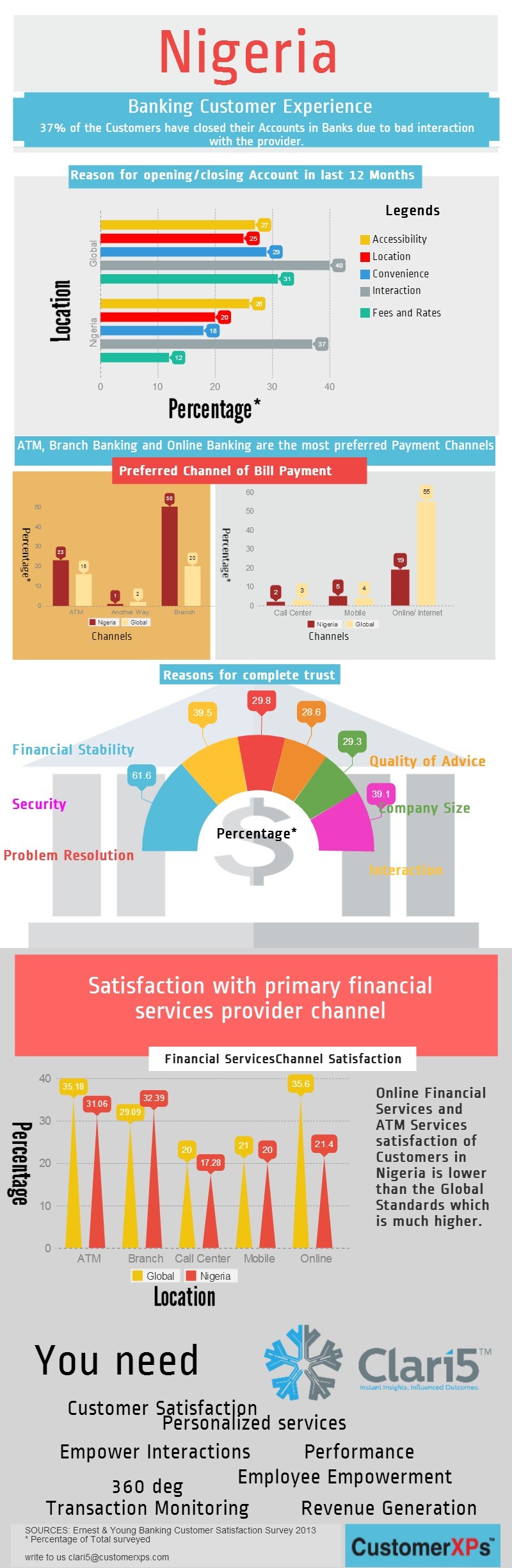

Customer Experience in Banks in Nigeria

Customer Experience in Banks in Nigeria

Customer Experience in Banks in Nigeria

Customer experience in banks has seen a downward trend in Nigeria since 2012. The study says, Nigerian Banks are going through turmoil. The reason is increasing fraud prevailing in the industry.The loss caused by fraudulent activities has mounted up to 19.06 billion Naira in 2012 from 1.65 billion Naira in 2000. . The fraudsters hit the bank hardest in year 2008 with whooping loss valuing around 34.8 billion Naira. With the increasing fraudulent activities via ATMs and Emails, banks are considering precautionary steps to combat the malpractices. While stringent actions are being taken to prevent fraud, the customer experience is also taking a hit. More and more customers are moving out of banks.

Therefore, to revive the banking industry from frauds & provide their customers’ a superior experience, banks are suggested to follow these aspects:

- Better interaction with Customers

- Better accessibility to services

- Secure and promote the preferred channel of payment and interaction

- Gain trust of the customer with:

o Better quality of Advice

o Enhanced Security

o Better Problem Resolution

According to globally set standards Nigerian banks are below par by standard. All the above parameters are highly crucial for better customer experience. So, the following info-graphics is an excerpt from Ernest & Young Banking Customer Satisfaction Survey 2013 which not only emulates the key concern areas but also throws light on how to overcome the obstacles. These actions will drastically improve customer experience and bring Nigerian banks at par with global standards.

Sources: Ernest & Young Banking Customer Satisfaction Survey 2013.