Clari5 Customer Experience Management

Clari5 Customer Experience Management for Banks

Clari5 knows that every banking customer is unique and provides the ability to offer individualized customer experience across all channels and communication. It has the ability to analyze and interpret every transaction intelligently and in real-time, which results in your banks conversations, services and products being highly relevant and contextual for the customer.

Customer Experience Management

Clari5 goes beyond the conventional 360° view and takes a holistic approach to every individual customer by constantly interpreting events to maintain your customer’s real-time receptiveness to cross-sell/upsell and customer-profile-based lifetime value. Clari5 CEM learns from transactions, interactions, responses and assimilates insight from across functional silos to deliver what is precisely relevant to your customer right at this moment.

Download Customer Experience Management Brochure

- Delivers instant contextual intelligence across all banking channels

- Powers every customer interaction with complete customer understanding

- Derives customer insights from multiple backend systems digested in real-time

- Empowers employees to provide the best service to its customers over every interaction effectively

- Increased revenue across channels through contextual cross-sell/upsell

- Enhanced Customer Satisfaction & Net Promoter Score

- Reduced Customer Turn-Around-Time (TAT)

- Increased Employee Productivity

- Clari5 Right Sell: Offers contextual & efficient real-time recommendations to the customers across all channels

- Clari5 Paperless Branch Banking: Revolutionizes branch banking by increasing teller efficiency as well as enhancing customer experience

- Clari5 Branch Booster: Enables branch managers to unlock opportunities present in the branch and convert them into immediate sale

- Clari5 Direct Channel Booster: Offers dynamic recommendations to customers across online and mobile channels via ads / marketing messages

- Clari5 Needs Analysis: Helps your bank acquire new customers quickly through intelligent needs analysis

- Clari5 Smart Teller: Empowers tellers with real-time intelligence before, during, after every customer interaction

- Clari5 Seeker: Leverages your bank’s own ATM channel to cherry pick competitor’s customers

- Clari5 iRM: Equips your relationship managers with real-time intelligence across your customer base

Right Sell

Delivering rewarding customer experiences in every transaction demands real-time insights that are contextual to your customers. Clari5 Right Sell pulls in the relevant intel from across all channels to provide personalized cross-sell/upsell offers that are precisely relevant to your customer at that moment.

Download Right Sell Brochure

- Next-best-action feature that recommends next best action for every customer in real-time

- Intelligent messages for sales opportunities in real-time

- Contextual Cross-sell/Upsell pitching

- Higher sales conversions at lower acquisition costs

- Customer delight due to precise, real-time contextual recommendations

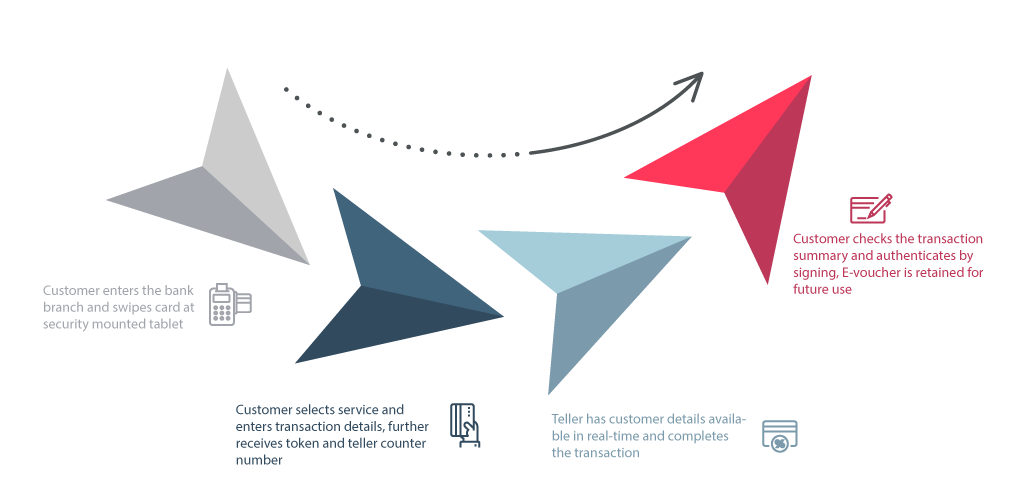

Paperless Branch Banking

Until recently, almost all banking was conducted at the bank’s local branch. Banking today has grown to include the net, mobiles, tablets, ATMs and call-centers.

This has resulted in a peculiar situation for banks. More customers in the branch without proportionate increase in revenue from footfalls simply adds to the cost of running branches. On the other hand, empty branches weigh heavily on the balance sheet.

Clari5 Paperless Branch Banking is an innovation that addresses your customers’ need for efficient and quick transactions at your branch. The solution includes smart tablets at branches aimed at increasing teller efficiency while enhancing customer experience.

Download Paperless Branch Banking Brochure

- Intelligent, precise mapping of customer to teller

- Installation and usage of tablets instead of teller machines

- Online token generation and connectivity to database for pre-filled information

- Generation of E-vouchers for every banking transaction

- Improved teller efficiency & productivity

- Reduced customer wait time at branch queues

- No filling up of forms

- Enhanced customer experience due to “signature on tablet” factor

Branch Booster

Branches are a bank’s costliest assets. But banks are often unable to leverage customer interactions at branches due to insufficient tools that are incapable of providing recommendations in real-time, thus impacting branch sales and having dissatisfied customers.

Clari5 Branch Booster empowers your Branch Manager with real-time insights to have intelligent conversations with your customers. It provides a real-time view of all sales opportunities at the branch, at that moment, with the ability to activate them using predictive analytics.

Download Branch Booster Brochure

- Anytime Customizable Branch Sales Dashboard providing a 360° branch view

- Teller efficiency monitoring

- Real-time customer detection capability

- Intelligent messages in real-time for contextual cross-sell/upsell

- Instant insights for customer conversations at branches

- Higher revenues from contextual cross-sales/ upsales

- Improved branch staff productivity

- Enhanced customer experience

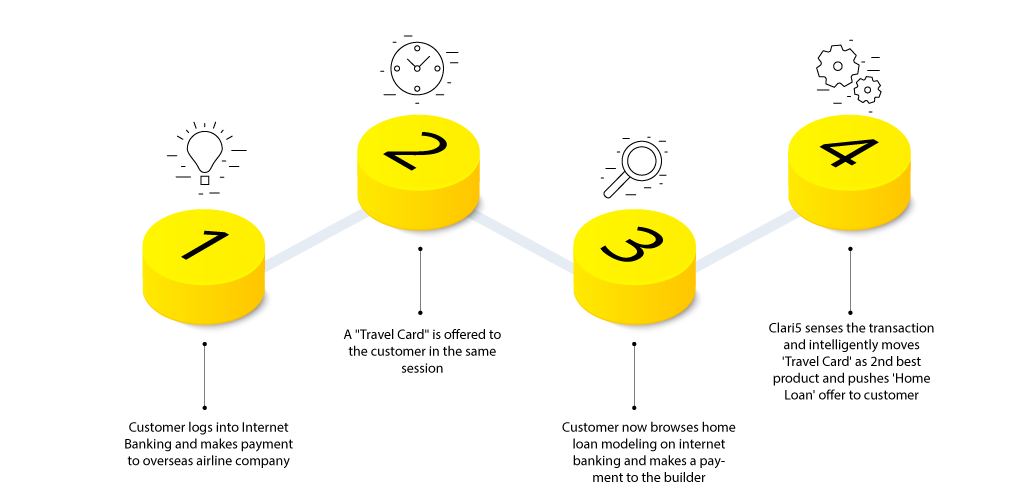

Direct Channel Booster

Internet Banking and Mobile Banking are undoubtedly the favourite channels for banking. The onus is on the banks to leverage these channels to the maximum for cross-sales opportunities.

Clari5 Direct Channel Booster delivers dynamic contextual recommendations to your customers via your online and mobile channels. The recommendations are in the form of real-time ads, marketing messages and smart, relevant prompts.

Download Direct Channel Booster Brochure

- Dynamic messages & advertisements that get re-adjusted based on in-session behaviour in real-time

- Intelligent recommendations in real-time for cross-sell/upsell

- Leverage existing investments to transform direct channels

- Higher sales conversions at lower acquisition costs

- Customer delight due to right product recommendation at the right time

- Contextual Cross-sell/Upsell pitching

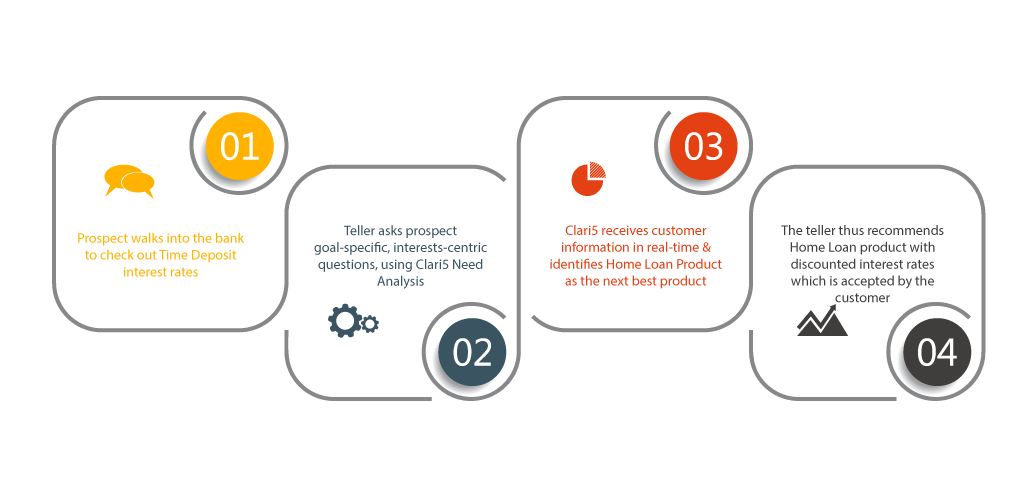

Need Analysis

In a fiercely competitive environment, it has become essential for banks to understand and precisely map customer needs to offer the ideal solution.

Clari5 Need Analysis helps your bank acquire new customers by providing real-time product recommendations based on your customers’ specific goals. It helps your customer-facing staff map optimal products to each customer to make intelligent recommendations.

Download Need Analysis Brochure

- Financial Goal setting feature for capturing customer’s goals for specified timelines

- Intelligent Need Analysis with Customer Conversation capability

- Dynamic product recommendation in real-time

- Ability to restart customer conversations at any point

- Option to take customer conversations forward on to web browser, tablet or mobile phone

- Reduced cost of customer acquisition

- Faster needs analysis owing to optimal product fitment

- Improved customer confidence and corporate reputation

- Quick ramp-up for new tellers and higher productivity

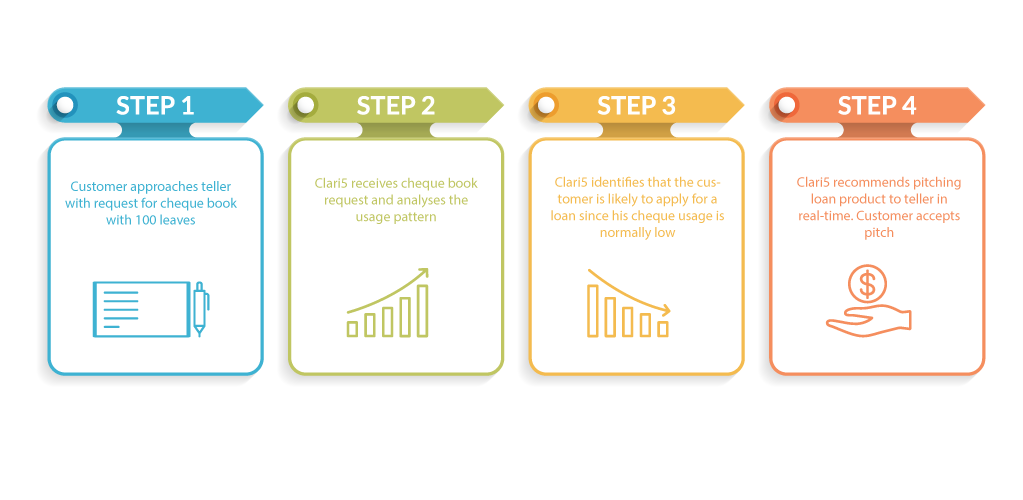

Smart Teller

With tellers being the customer’s first point-of-contact, the onus of providing delightful customer experience lies on them.

Clari5 Smart Teller empowers tellers at your bank’s branches with real-time insights which helps them make intelligent conversations for increasing customer loyalty and improving branch sales.

Download Smart Teller Brochure

- Next-best-action feature that recommends Next Best Action for every customer in real-time

- Single screen view to assist the teller with all important tasks/events lined up for the day

- Intelligent, real-time, system generated conversation pointers including cross-sell opportunities and KYC

- Chat feature to capture tacit information about customers

- Instant insights for customer interaction at branches

- Improved teller efficiency

- Reduced customer wait time at branches

- Customized interactions leading to higher customer satisfaction

- Increased cross-sell because of intelligent pointers

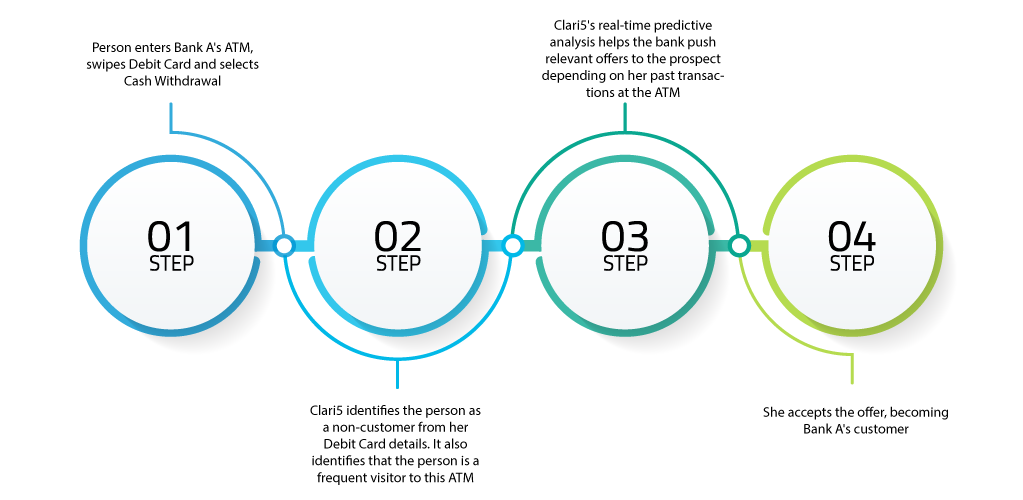

Seeker

ATMs are one of the most prevalent customer touchpoints. Despite the usage frequency, banks are unable to leverage this powerful channel for new customer acquisition.

Clari5 Seeker is a smart solution that leverages your bank’s ATM channel to cherry pick your competitor’s customers. Clari5 studies their behaviour patterns and offers personalized recommendations.

- System engages with the bank’s competitors’ customers for repeat usage and observes individual behavior

- Intelligent messages in real-time for contextual offers

- Compatible with high-end POS systems

- Optimized segmentation & targeting

- Acquiring competitor’s customers at a fraction of the cost

- Contextual cross-sell pitching

- Highly customized interactions

- Easy integration with existing core banking system

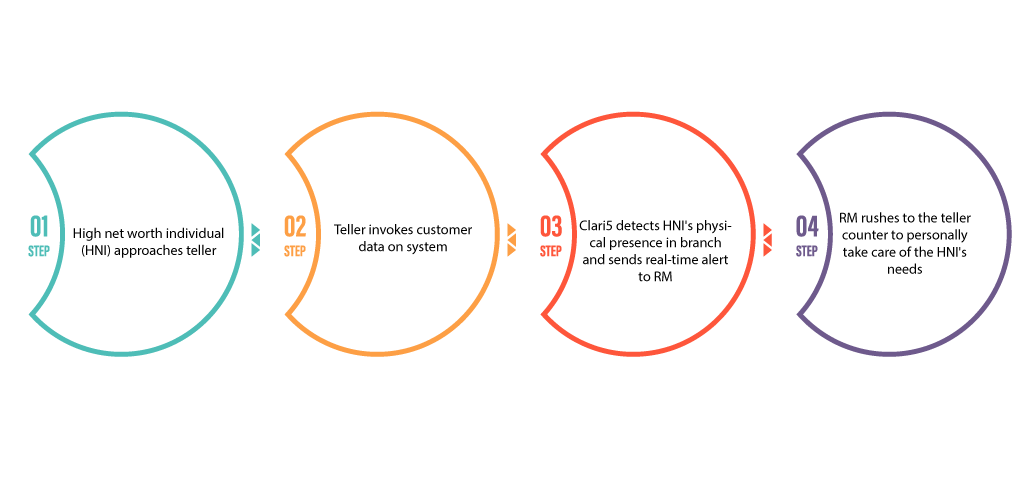

iRM

By delivering rewarding customer experiences, Relationship Managers (RMs) play a vital role in branch banking. But more often than not, non-availability of real-time customer insights ebbs their performance.

Clari5 iRM is an advanced mobility product that interprets your customers’ structured/ unstructured events in real-time and delivers inferences that instantly empower your RMs to provide far better personalized services.

Download Clari5 iRM Brochure

- Customizable real-time dashboards generated for Relationship Managers

- Real-time messages on RM’s tablet for servicing HNIs

- 360° customer view including personalized recommendations

- Customer presence detection in real-time

- Highly personalized RM interactions leading to enhanced customer experience

- Higher cross-sales revenue

- Round-the-clock customer interfacing

- Improved sales acquisition time at lower costs

How can Clari5 help my bank?

Schedule a Demo

Schedule a 1:1 discovery demo call with our senior product experts to see how Clari5 works and have all your questions answered!