(Sequel to the 2-part blog on improving Customer Lifecycle Management in financial institutions)

Image courtesy: @tawatchai07 on Freepik

Image courtesy: @tawatchai07 on Freepik

‘Well begun is half done’

– Aristotle

In the prequel, we saw how financial institutions can initiate a streamlined CDD-led customer onboarding experience.

Let us now see what it takes to manage what lies ahead.

By thinking more strategically about the customer lifecycle journey – from targeting to acquisition to servicing and developing – and making smarter use of advanced data, analytics and with help from technology, financial institutions can diligently improve customer experience and reduce attrition.

Most FIs are already interpreting the customer’s internet banking and mobile banking behaviour to provide more hyper-personalized services. Leveraging customer transactions and interactions in real-time help make precise ‘segment of one’ cross-sell / upsell recommendations.

To build better relationships, some FIs are also sourcing alternative data, for e.g., customer payment histories for mobile phones, utilities, even cable TV. This data augments traditional credit data with more dimensions to spend behaviours.

When combined with credit data, alternative data can also be a good indicator of the risk potential of customers. In most cases, a reliable risk score for retail banking can be successful in determining account risk. The score can also help identify applicants who might otherwise be turned down, but who have low risk, based on their payment history from alternative data.

By viewing risk scoring from a fraud prevention perspective, FIs can go beyond assessing the viability of new customers and begin addressing dormant or evolving fraud such as ATOs and bust-outs (where seemingly good customers max out available credit before vanishing). Specialized financial crime risk management solutions help identify suspicious activities and potential fraud patterns that are at play in other institutions, and deliver that information in real-time.

These solutions also help FIs maximize revenue and margin at every step along the customer lifecycle, from acquisition to upsell / cross-sell to loyalty / retention to debt management – all while maintaining continuous and stringent due diligence.

A good CLM-enabling solution will help continuously analyse customer behaviours and needs, determine the right objectives (acquisition or retention), and identify ideal ways of targeting them. Specifically, a good solution will –

- Deliver contextual real-time interactions in real-time. This increases customer wow leading to increased loyalty. Real-time contextual insights to trigger the right conversations in real-time that is relevant to customers.

- Enable the front-line to do qualitatively more within the same time window and with lesser effort to enhance performance / motivation levels while shrinking customer interaction time.

- Perform continuous risk categorization based on demographic / geographic profiles, product subscriptions, and transactional behaviour profiles, watch list matches, CTR / SAR filings and identify AML red flags based on pre-defined scenarios.

- Have comprehensive investigation capabilities like case creation and workflow management, case assignment for further due diligence and link analysis.

- Invoke timely KYC / CDD interventions to help accelerate onboarding and ongoing relationship management while keeping a check on the risk factor.

- Ensure the FI stays compliant with changing regulatory demands and reduce the pressure on the compliance organization.

- Superior CX equals stronger customer connection and faster monetization.

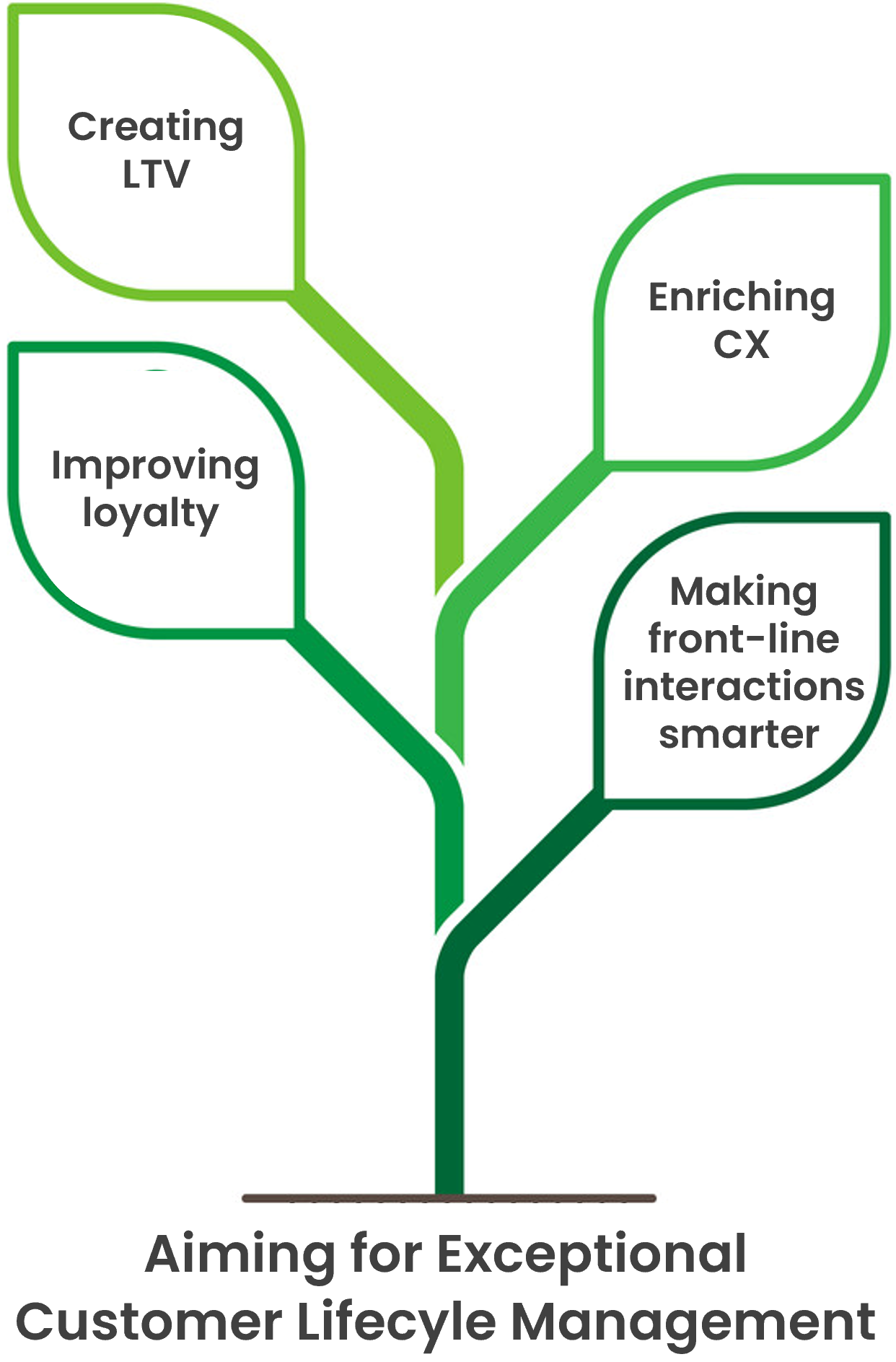

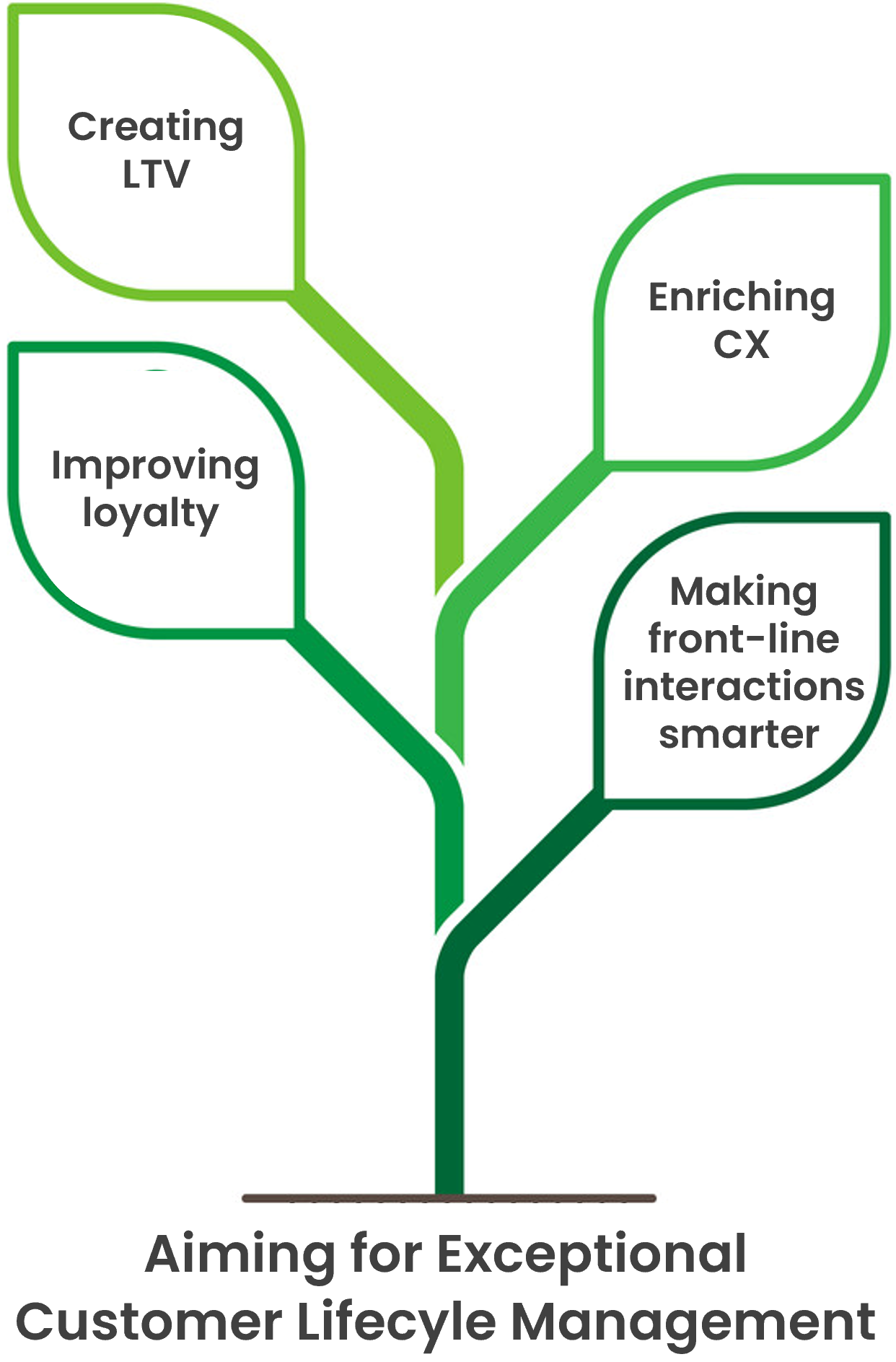

More importantly, it helps FIs enhance the 4 key CLM priorities:

Making front-line interactions smarter

This is an area most FIs struggle with because they strive for absolute real-time, ‘in-the-moment’ insights that are quick and easy to comprehend and actionable. FIs can transform customer-facing staff interactions with real-time insights extracted from deep customer analytics. AI and Machine Learning-led cross-channel customer insight solutions synchronize and synthesize customer intel from across the enterprise and deliver actionable ‘essence’ to the front-line in real-time.

Improving loyalty

Some of the retention challenges financial institutions face include poor metrics on attrition and the lack of an enterprise-wide unified view of the customer. Most financial institutions reactively try to hold on to customers, versus taking a proactive approach before customers decide to leave. FIs can build integrated, cross-functional programs with an in-depth understanding of affinity and traction in relation to new and existing customers. Real-time insights help financial institutions create and monetize customer loyalty programs faster and fine-tune program features to maximize ROI.

Enriching CX

Great CX is a good blend of robust processes, analytics-driven real-time interventions and an exceptional service culture. A CX framework that dovetails with the larger business strategy enables delivering quantifiable value. From price to the product to service, financial institutions can evaluate key customer interaction touchpoints to determine the right experience level to provide, based on a combination of customer expectations and the relative value of each customer.

Creating lifetime value

Financial institutions accumulate enormous volumes of disparate and new sources of data and have the power to achieve the proverbial 360-degree view of the customer. Specialized solutions with the support of deep-analytics and access to relevant contextual insights that help monetize upsell / cross-sell opportunities help deliver significant and sustainable impact.

From acquiring to onboarding to strengthening relationships to growing upsell / cross-sell revenues, while complying with regulatory norms, a sustained, superlative and diligent CLM helps FIs traverse an exciting journey that is not just begun well but also advanced well.

De-risking Onboarding with Cross-channel, Real-time Customer Due Diligence