-

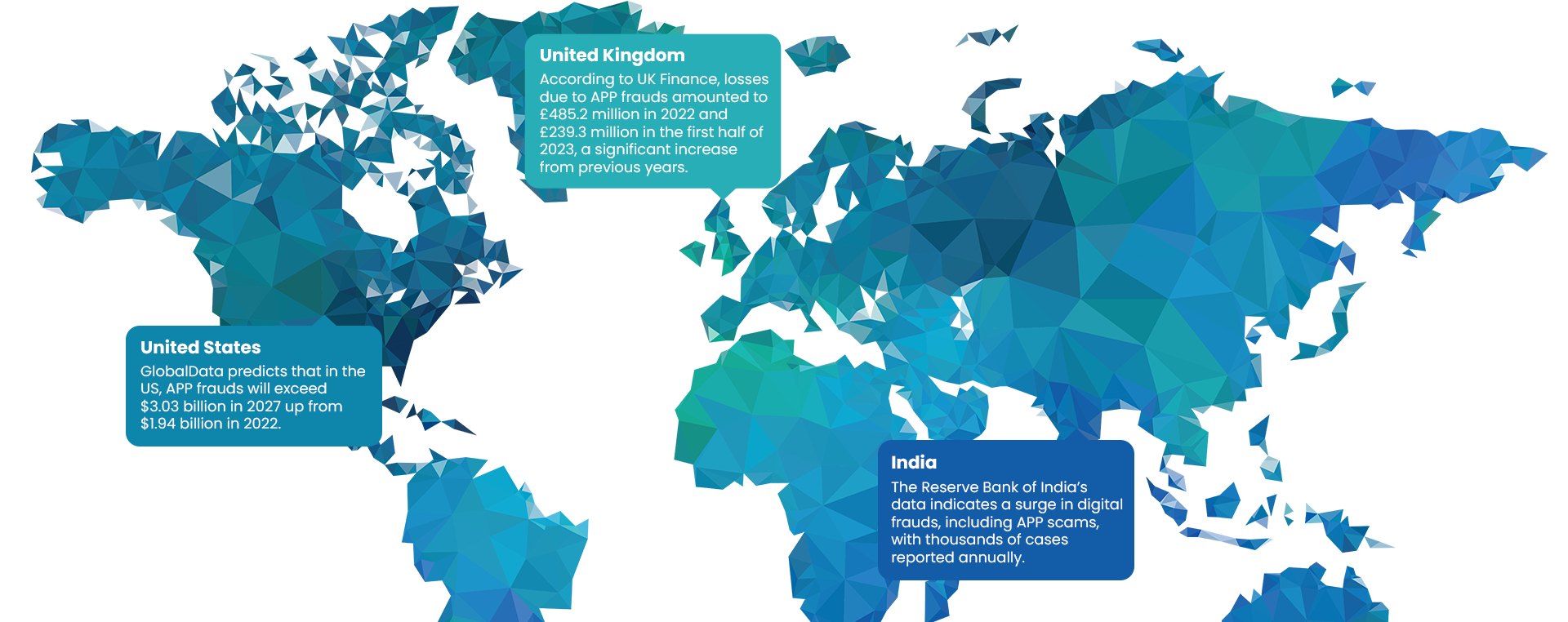

- Global Perspective: The global dimension of APP frauds is vast, with international agencies like INTERPOL and Europol recognizing it as a growing concern in advanced economies.

- Variety of Tactics: Fraudsters use a range of tactics to commit APP fraud. These include impersonating bank staff, government officials, or business partners; sending fake invoices that mimic those from legitimate suppliers; and hacking email accounts to intercept and alter payment details.

- Challenges in Recovery: Recovering funds lost to APP fraud can be challenging. While some financial institutions have committed to reimbursing victims, the specifics can vary widely between banks and jurisdictions. In some cases, victims may not be refunded, especially if they authorized the payment

What is What?

- Authorized Push Payment (APP) Frauds: Authorized Push Payment (APP) fraud occurs when fraudsters deceive individuals or businesses into voluntarily sending money directly from their bank account to an account controlled by the fraudster. Unlike traditional fraud methods that rely on unauthorized transactions, APP fraud involves tricking the victim into authorizing the payment themselves. This can make it particularly insidious and challenging to address because the transaction appears legitimate from the bank’s perspective.

- Mule Account Frauds: When an individual or company moves or transfers illegal money for another party, it’s known as money muling, also known as mule fraud. The fact that the funds have illicit origins—fraud or trafficking —may be the reason the owner is attempting to dissociate oneself from such assets. A mule account is the one that a money mule uses. Using a mule separates criminals from their money, which makes it more challenging for law enforcement to follow money trails.

How financial institutions can mitigate APP and mule account frauds

Understanding Your Customer’s Behaviour: Institutions should review the normal interactions that clients have with all banking channels in order to create a baseline of “normal” and spot unusual transactions. The purpose of this profile is to identify deviations and compare new activities.

Analyzing Large Amount of Data: Banks should be capable of sorting through massive amounts of transactional data in real-time to find any odd or fraudulent activity.

Machine Learning Model for APP Frauds and Money Mule Detection

Clari5 Machine Learning model for mule account detection can predict whether the account is mule or not by analyzing the various signals on the account. It uses a combination of demographic data on the customer, account and the transactions to assess this. This information is coupled with data changes on the account like mobile number, address changes, mobile banking enablement etc to give a razor focused result on the probable mule accounts.

Connect with us to discuss more on APP and mule account frauds.

Gijima, leading South African ICT company partners with Clari5 to jointly help African banks combat real-time cross channel enterprise crime management. Through this strategic partnership, Gijima and Clari5 will provide solutions to African banks to counter enterprise-wide fraud and money laundering risk. Banks across Africa can now benefit from the unparalleled advantages of Clari5’s extreme real-time, cross channel, enterprise fraud risk management capability.

Gijima, leading South African ICT company partners with Clari5 to jointly help African banks combat real-time cross channel enterprise crime management. Through this strategic partnership, Gijima and Clari5 will provide solutions to African banks to counter enterprise-wide fraud and money laundering risk. Banks across Africa can now benefit from the unparalleled advantages of Clari5’s extreme real-time, cross channel, enterprise fraud risk management capability.