Clari5 Cross-Channel Loan Origination and Monitoring Solution

Clari5 Loan Origination and Monitoring Solution

Building a high-quality loan portfolio is critical to banking. The process starts at loan origination and continues throughout the loan term. Clari5 has a data analytics solution that identifies the best potential loan customers and monitors each loan throughout the loan term while simultaneously detecting loan fraud.

How does Clari5 Loan Origination and Monitoring Solution help you?

Clari5 uses data to assist a bank’s decision-making process. During the origination process for an existing banking customer, Clari5 assesses the credit worthiness of the applicant. Analytics with AI/ML can provide additional data points to determine credit worthiness and correct loan amounts.

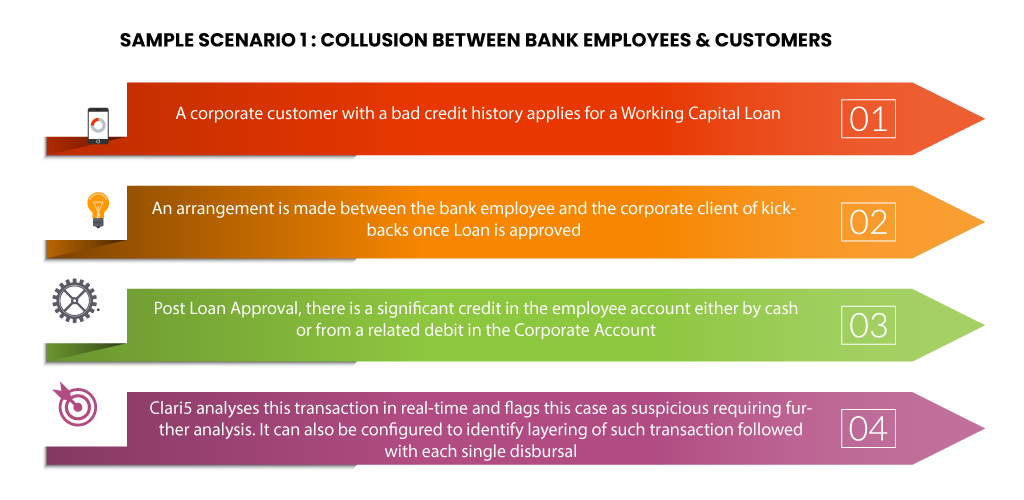

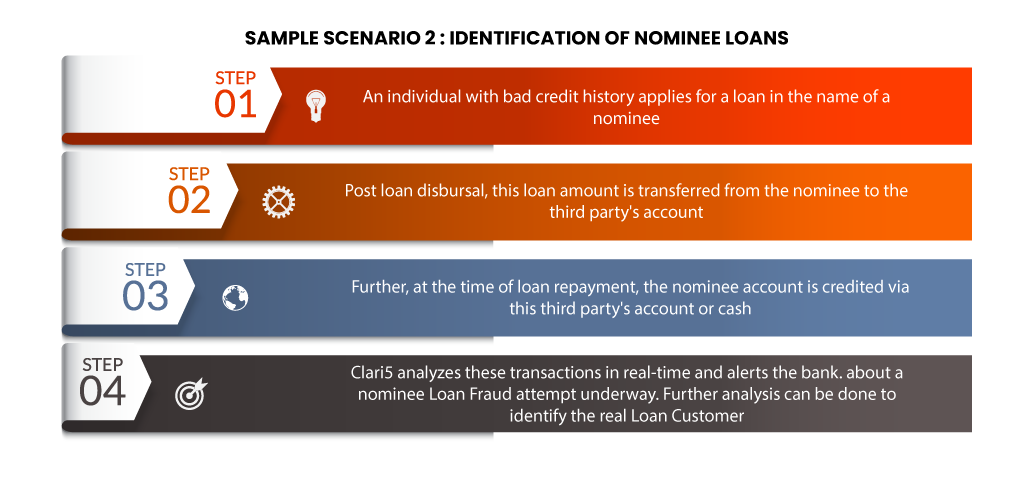

In addition to helping determine credit worthiness, banks can leverage Clari5’s industry leading fraud detection platform to identify fraudulent applications which further strengthens and safeguards the loan portfolio.

Every loan needs constant monitoring. Financial conditions change for companies and individuals, and these situations have ripple effects that can have major impacts to the bank. Clari5 provides daily visibility by analyzing daily transactions to identify signals that could predict early loan repayment issues or fraud. Banks often miss the most basic signs of ‘at risk’ loans with current systems which only monitor compliance with covenants for their biggest loans. Clari5 monitors each loan regardless of the amount, to give loan authorities and bank executives a complete view and deep insights into the entire loan portfolio. Instead of risks getting identified after the fact, Clari5 helps to predict potential problem areas immediately.

Download Loan Origination System Brochure

Additional Resources: read the blog on how smaller financial institutions can combat loan frauds.

- Single portal to control all frauds within the Credit Cycle

- Configurable solution that allows Scenario deployment in the real time

- Transaction Monitoring for all sets of operations beginning from Loan Application to Loan Disbursal and Collections

- Customizable Product master with an ability to dynamically configure new products

- Web based Scenario engine for creation of new fraud scenario as and when required, without coding or any effort from the IT team

- Control Internal Fraud where colluding employees connive with customers to perpetrate fraud

- Trigger Suspicious Cases to fraud Monitoring team for the detailed Analysis and Reporting

- Multi-channel environment deployment for seamless experience across the channels

- Capability to report Loan Defaults according to Central Bank’s Guidelines

Loan Analytics

Clari5 compiles a comprehensive history of every account, and then provides the data, reports, and dashboards to allow loan departments to quickly assess each customer’s historic cash flows, cash to debt ratios, credit line drawdown ratios, and NAICS industry so that each loan officer can have the information to determine the right mix of programs for each customer. In the long run, Clari5’s Loan Analytics platform is invaluable in assessing the real-time health of your loan portfolio.

Download Loan Analytics Brochure

How can Clari5 help my bank?

Schedule a Demo

Schedule a 1:1 discovery demo call with our senior product experts to see how Clari5 works and have all your questions answered!