Money Laundering Bulletin’s latest article on sifting out false positives from transaction monitoring alerts, talks about how Clari5 is helping financial institutions realise the benefits of AI and machine learning models.

The first in the two-part series on improving customer lifecycle management in banks, explains how banks while focusing on delivering a great on-boarding experience, can simultaneously ensure stringent customer due diligence.

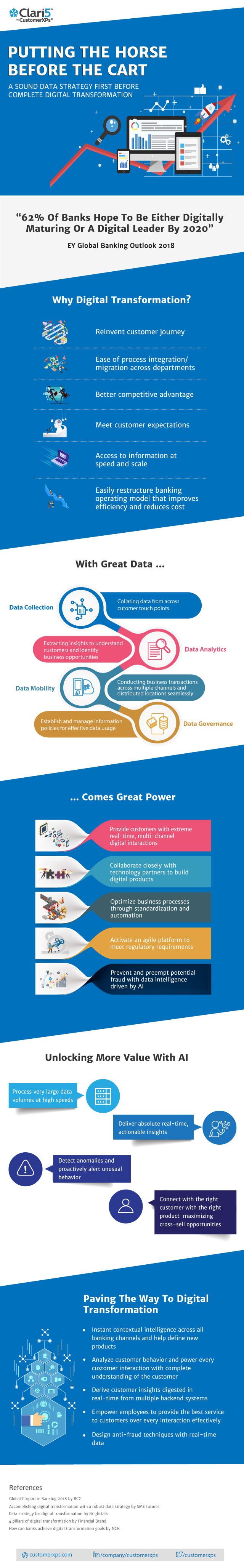

Read how customers are dictating the success (or) failure of banks; why analytics is now even more central to a bank’s data strategy; what is stopping banks from achieving superlative customer data analytics and how banks can scale the power of data.

Effective banking enterprise-wide digital transformation requires a sound data strategy in place first. What should be the key considerations while laying a solid data foundation?