Month: August 2014

Simplifying Banking Engagement!

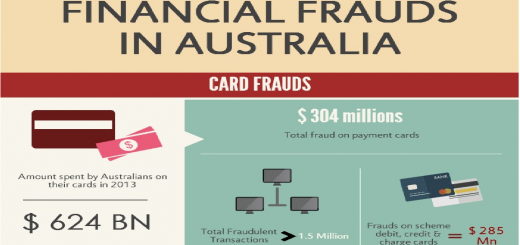

Financial Fraud in Australia

Financial Fraud in Australia

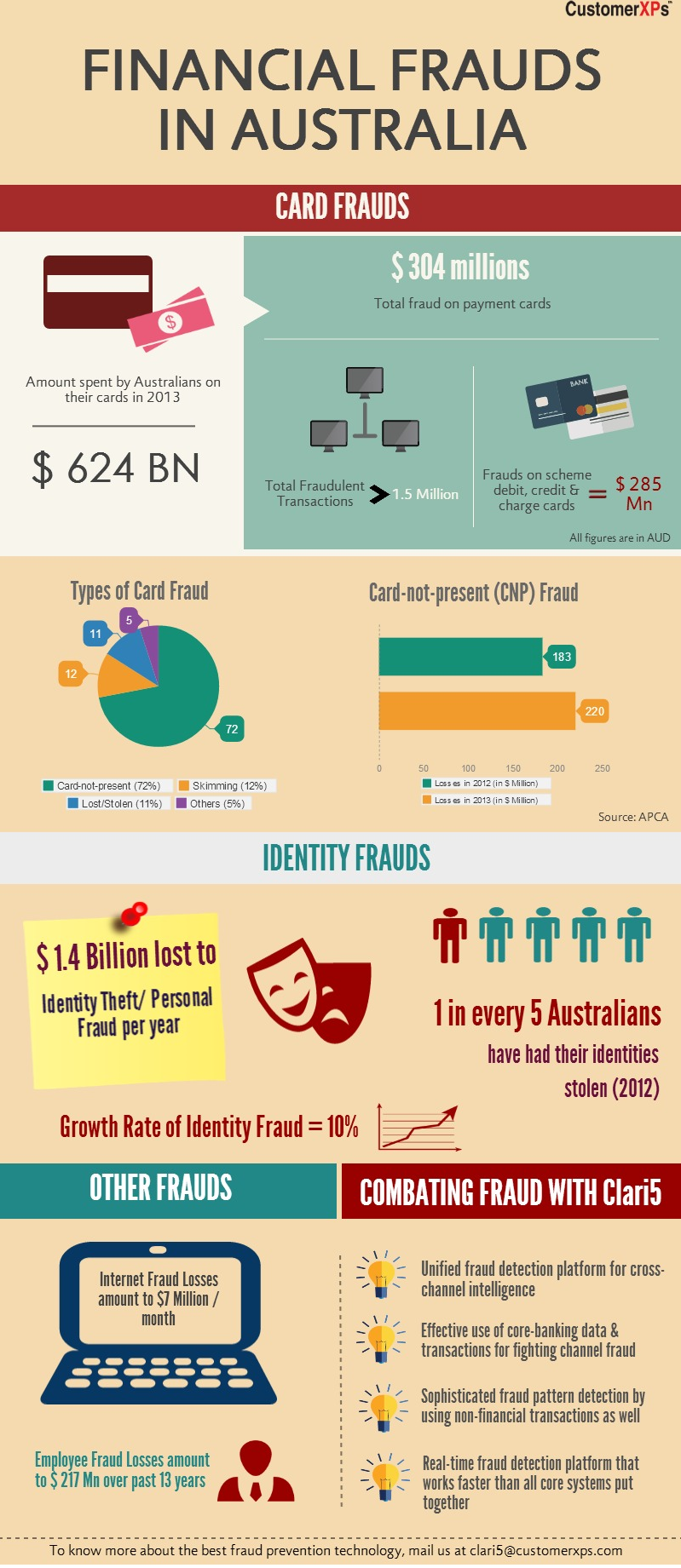

Financial fraud is pervasive. Not only developing but developed countries grapple with fraud. With new channels of financial transactions opening up for consumers, it is becoming even more difficult to monitor fraudulent events in real-time. For instance, online banking & payment cards have become so ubiquitous that we cannot imagine transacting without them in our day-to-day life. On the other hand, banks are threatened by high levels of fraud that are associated with electronic transactions. In Australia, the total amount of money spent on payment cards was AUD 624 Billion in 2013. At the same time, an estimated AUD 1.4 Billion was lost to personal fraud that has emerged as the largest form of financial fraud in Australia.

This infographic below delves deeper into the fraud scenario in Australia and highlights ways to combat fraud in real-time.

Simplifying Banking Engagement!

Simplifying Banking Engagement and Empowering your Customers

Rapid change in the banking technology and the behavior of customers pushes banks to be on par with the industry. Gone are the days where everything was complex starting from standing in the queue, filling the form, money transfer, etc. Customers are now searching / looking for those products and companies that can simplify their lives.

Simplicity is mutually beneficial to both customers and banks. In this digital generation where people are always online and busy, expect banks to make their banking experience easier. Customers these days are demanding greater personalization, flexibility, better value, improved service, choice and control. Banks need to reevaluate their assumptions and fundamentally change how they interact with their customers. Giving more power to customers by making them have greater control over their money may be uncomfortable to banks, but in the long run it will fetch great result and success.

To simply engagement with customers, banks have introduced multi-channel banking. Multi-channel banking is the buzzword in today’s banking world; the banks are competing to increase their reach by adding new customer touch points, including laptops, PCs, mobile phones, tablets, smart ATMs. Banking on the go is one of the basic need of this tech savvy, young population.

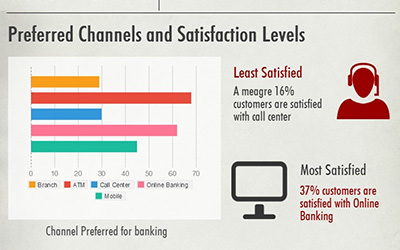

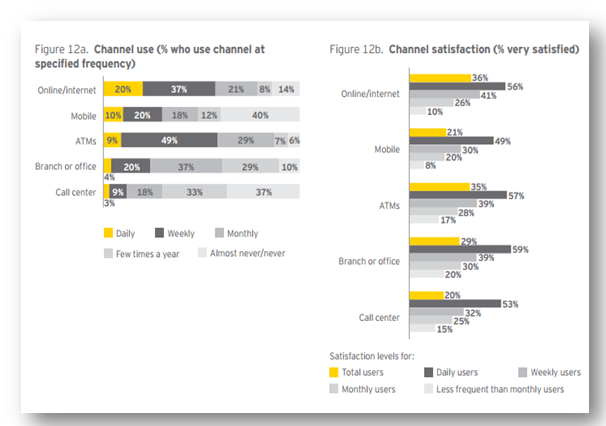

Study below shows the channel usage and their satisfaction level. Source (EY Global Consumer Banking Survey 2014)

The graph above depicts the most commonly / frequently used channels: Online, Mobile and ATM’s tops the chart. When we talk about the satisfaction level of these channels Online and ATM’s are commonly used by the customers with 36% & 35% of satisfaction level each. On the other hand channels like Mobile and Branch offices satisfaction level is less compared to online channels.

Apart from using multi-channel banking, banks should encourage their customers to play an active role in tailoring their products and services that alleviate and fix problems. Also, customers care more about convenience than about channels. Banks need to look beyond multi-channel toward a fully integrated banking experience. Banks should focus on marketing offers that are relevant to them and send alerts in real-time. This will not only simply banking engagement, but also enhance the customer experience.

Customer Experience is paramount to establish trust and confidence in banks. Customers are becoming more assertive and taking greater control of their banking relationships. Customers are now more demanding and want their banking experience to be simple, easy and tailored according to their needs. Hence, banks should customize the services based on the customer needs.

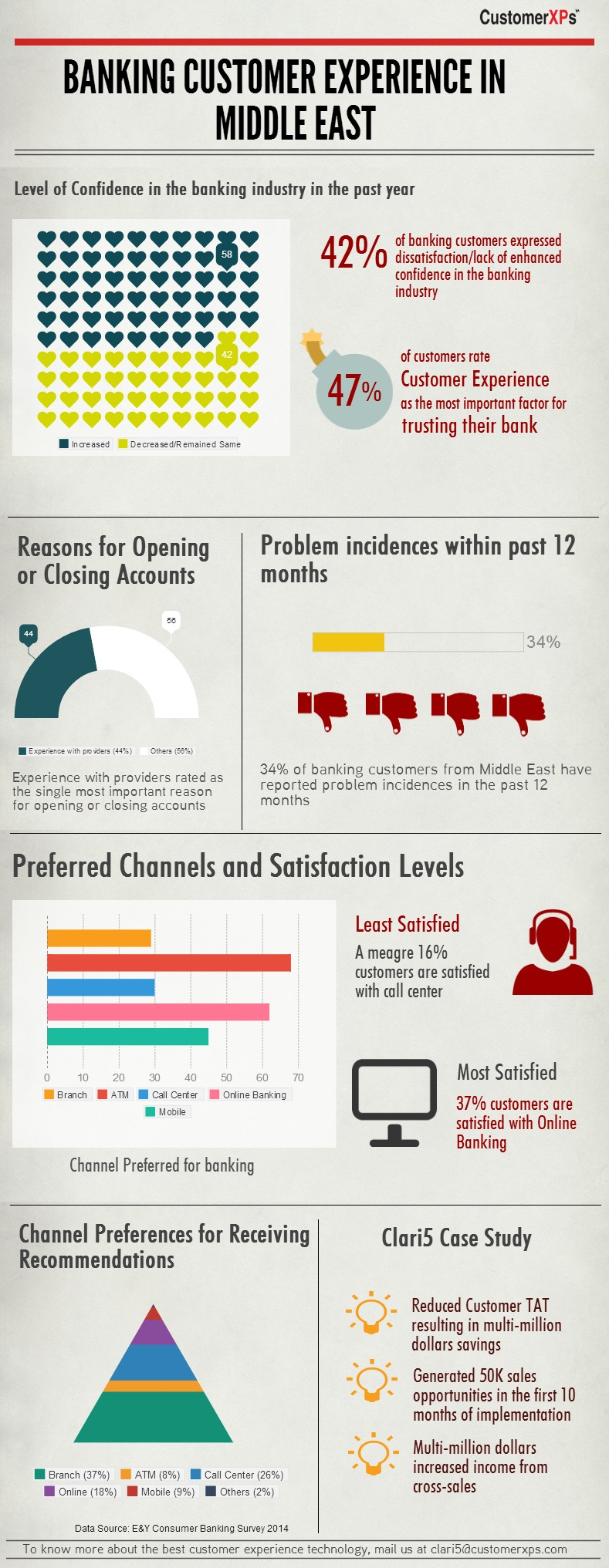

Banking Customer Experience in Middle East

Banking Customer Experience in Middle East

Banking Customer Experience in Middle East

The growing importance of customer experience has taken over the banking industry by storm. A recent report published by E&Y details out latest trends in customer experience from around the globe and suggests that banks should aggressively leverage valuable insights from customer behavior to effectively chart out their customer experience strategy.

The infographic below throws light on banking customer experience in Middle East and how implementing real-time technology solutions result in customer delight by making use of deep customer insights.