The Bangko Sentral ng Pilipinas (BSP) recently issued a circular requiring all banks and e-wallet providers in the Philippines to implement real-time, automated fraud management systems within a year. This marks a crucial moment for the country’s financial ecosystem, aligning regulation with the rapid growth in digital transactions and rising fraud risks.

Why Now?

The Philippines’ digital payments landscape has grown at an impressive pace in recent years:

- Over 43% year-on-year growth in digital payment transactions as of 2024

- Target of 50% of retail payments to be digital by 2026, already surpassed in 2023 at 52.8%

- A mobile-first consumer base and an expanding e-wallet ecosystem

However, this success has brought significant challenges. Digital fraud has surged:

- Online fraud incidents rose 85% year-on-year, based on recent reports

- The digital fraud rate hit 13.4% in 2024, nearly 150% higher than the global average

- E-wallet fraud is now the most common consumer complaint, with major providers frequently cited in reports

- Online scam complaints tripled in 2024, with over 10,000 cases reported to the Cybercrime Investigation and Coordinating Center (CICC)

This BSP directive is about more than compliance. It’s about rebuilding and reinforcing public trust in digital financial services — which is essential for sustaining growth.

What the Mandate Requires

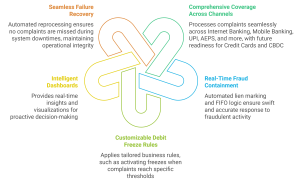

The circular sets clear expectations for banks and e-wallet providers to deliver:

- Automated Fraud Monitoring: Continuous oversight to spot anomalies

- Real-Time Detection: Immediate identification of suspicious patterns

- Instant Blocking: The ability to stop fraudulent transactions before completion

- Integration with AML Systems: A unified approach to financial crime risk

- Continuous Customer Monitoring: For post-onboarding fraud detection and risk profiling

- Robust Consumer Education: Helping customers understand and avoid scams

These capabilities are essential for tackling increasingly sophisticated fraud, from account takeovers and synthetic identities to organised scam rings and mule networks.

A Continuum of Regulatory Progress

This mandate builds on other BSP and regional efforts to strengthen digital trust, including:

- Enhanced Transaction Authentication introduced in 2024

- QR Ph Person-to-Biller Expansion to promote seamless, cashless bill payments

- Upcoming AI-Specific Banking Regulations to ensure accountability in AI-driven fraud detection and AML analytics

- FATF Grey List Review & On-Site Evaluation, encouraging stronger KYC/AML standards and ongoing monitoring

- AFASA & IT Risk Amendments mandating real-time fraud monitoring and post-onboarding detection

- BCCR regulations enhancing oversight of fraud-related consumer complaints

- CASP Guidelines, relevant for those expanding into digital assets

Together, these measures reflect a maturing regulatory environment that balances innovation with accountability and consumer protection.

What Will It Take to Comply?

For banks and e-wallet providers, meeting the mandate will require a meaningful shift in capability:

- Enterprise-grade real-time decision engines to handle high transaction volumes

- Machine learning-powered behavioural analytics to detect fraud across diverse channels

- Cross-channel integration linking mobile apps, online banking, ATMs, e-wallets, and merchant platforms

- Tightly integrated AML and fraud risk systems for a unified view of financial crime risk

- Scalable architectures that can adapt to evolving regulatory demands

Institutions that see this as a strategic transformation, rather than a compliance checkbox, will be best placed to scale safely as the Philippines deepens its digital finance ambitions.

Beyond Compliance and the Cost of Inaction

Real-time fraud management is not just about ticking boxes. It is a strategic investment that helps banks and e-wallet providers:

- Build and maintain customer trust

- Reduce fraud losses

- Deliver better experiences with friction-right authentication

- Show leadership in safeguarding the digital financial system

Those who aim higher than minimum compliance will gain a competitive edge as consumer trust becomes the critical differentiator.

At the same time, delaying or underinvesting carries real costs—direct financial losses, reputational damage, and potential regulatory penalties. In a highly competitive market, those costs can quickly exceed the investment needed to modernise.

It is worth noting the Philippines isn’t alone in this push. Regulators across ASEAN, from Malaysia’s BNM to Indonesia’s OJK, are also lifting expectations around real-time fraud monitoring and AML integration. Institutions that act early can avoid fragmented, reactive upgrades later, and also set themselves apart as leaders in a region that prioritises safe, inclusive digital finance.

A Moment for Market-Wide Collaboration

This mandate is both urgent and necessary. It calls on Philippine financial institutions to take a proactive stance: rethinking their frameworks, modernising technology, and collaborating with experienced partners in real-time financial crime risk management.

In the coming months, we can expect further clarifications, industry discussions, and technology evaluations. Institutions that move early won’t just ensure compliance, they will strengthen their fraud defences and position themselves for long-term growth in a market where digital trust is the new currency of success.

Read more about real-time fraud defence frameworks at Clari5 Banking Solutions.