Clari5 Enterprise Fraud Management

Clari5 Enterprise Fraud Management for Banks

Clari5 Enterprise Fraud Management Solution is a real-time intelligent Big Data solution that combats sophisticated fraud with real-time, actionable insights. It monitors suspicious activities in real-time, and takes the right decision at the right time as opposed to end-of-day reporting and analysis. Clari5 EFM is designed to meet the fraud detection, investigation, prevention, monitoring compliance and audit needs of banks.

Enterprise Fraud Management Solution

Download Enterprise Fraud Management Brochure

- Implemented successfully in large global banks

- Combats cross-channel, cross-product fraud (internal fraud, identity theft, ATO, credit card fraud, CNP fraud, etc.) across the bank

- Cross-pollinated intelligence in extreme real-time

- Customer aware solution digesting all transactions, events and actions

- Silo Breaker with actionable insights

- Out-of-the-box integration with widely used core systems

- Rapid on-premise or SaaS deployment

- Reduced financial & reputational loss

- Reduced sophisticated fraud across channels

- Reduced false positives

- Lower operational costs

- Regulatory compliance

- Clari5 Employee Fraud Management: Enables real-time employee or internal fraud prevention

- Clari5 Real-Time Transaction Monitoring: Protects banks against core-banking frauds like customer, account and employee level frauds

- Clari5 sMitch: Allows customers to Switch On/Switch Off Card transactions by category and indicate their spend rules through mobile banking or internet banking

- Clari5 Cross-Channel Fraud Monitoring: Proactively combats Cross-Channel and Cross Product fraud in real-time

- Clari5 Payment Card Fraud Management: Provides payment instrument issuer, payment processor or a merchant acquirer the necessary arsenal to monitor, detect and prevent fraud

- Clari5 Online Banking Fraud Prevention: Empowers banks to detect and prevent fraud before the online banking transaction is completed and take necessary action to prevent the damage

Employee Fraud Detection

The growing prevalence of internal fraud has mandated use of technology solutions to counter such instances. The need of the hour is a comprehensive solution that scrutinizes suspicious employee behavior and immediately prevents fraud from taking place.

Clari5 Employee Fraud Management enables real-time prevention of employee or internal fraud. It enables the bank to systematically enforce a fraud-free culture while controlling and detecting access to critical customer information.

Download Employee Fraud Detection Brochure

- Early warning system to detect anomalous employee behavior

- Preventive vigilance on employee activities

- Monitors Employee, Office and Customer accounts for any repeated suspicious behavior

- Integrates banking systems like Core banking systems, CRM and HRMS to identify anomalies

- Integrated hierarchical case management for investigation and closures

- Reduced insider fraud and fraudulent events

- Reduced monetary & reputational Loss

- Regulatory compliance & auditing

Transaction Monitoring

Core banking is one of the most important channels for banking since the bulk of high-value transactions pass through it. In spite of its vulnerability, most of the core-banking transactions are monitored post-facto that leaves enough room for fraudsters to get away with the fraud.

Clari5 Real-time Transaction Monitoring solution protects banks against core-banking frauds like customer, account and employee level frauds. It makes use of real-time intelligence and predictive analytics to detect and stop/hold suspicious transactions as they happen in the core banking system.

Download Transaction Monitoring Brochure

- Monitors financial and non-financial core-banking transactions with cross-pollinated intelligence gathered across all other channels

- Provides real-time alerts on employee fraud such as unauthorized customer account access, repeated charge waivers to customers, high volume TOD issues, etc.

- Monitors all transactions and alerts the department concerned of any fraudulent pattern identified or of any potential fraud threat

- Delivers real-time alerts for ATO Fraud, Threshold Breach, Money Mule Accounts, etc.

- Prevents suspicious transactions from advancing and creates cases for the Fraud Investigation Team

- Shields your bank from all core-banking frauds

- Perpetual monitoring of financial & non-financial inquiries

- Reduced reputational loss due to fraud

- Improved customer loyalty and advocacy

- Aids regulatory compliance and auditing

Online Banking Fraud

The growing menace of account takeovers and identity thefts are severely impacting the safety of online banking transactions. Combating such frauds in real-time becomes even more critical given the vulnerability of the channel involved.

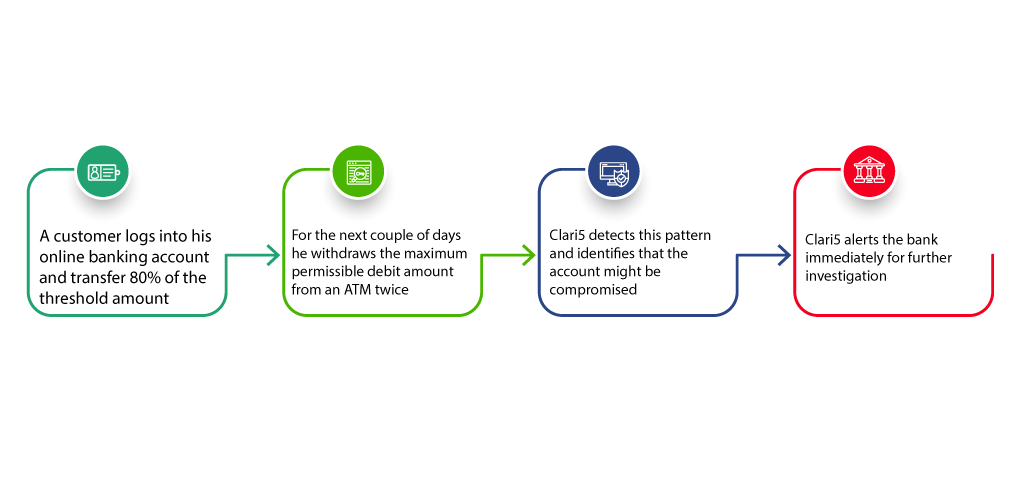

Clari5 Online Banking Fraud Management provides a foolproof mechanism for threats such as Identity Theft, ATO and Money Mules. It identifies fraudulent activities across the bank by monitoring all online banking transactions including logins, beneficiary registrations and fund transfers.

Clari5 helps detect and prevent the potential fraud before the online transaction is completed and takes necessary action to prevent the damage.

Download Online Banking Fraud Prevention Brochure

- Real-time fraud risk advice established on bank policies with the help of Decision Strategy Manager

- Pre-packaged scenarios to prevent ATO, Money Mule and Mandate Fraud

- Integrated advanced Case Management based on behavioral patterns

- Integrated fraud risk reports & dashboards

- Option to integrate with existing systems or use Clari5 for additional authentication

- Instant detection of complex IB fraud schemes

- Reduced fraud losses and quicker ROI with real-time fraud prevention

- High performance with sub-second response time for real-time risk advice

- Improved customer confidence and loyalty

- Reduced reputational loss due to fraud

Payment Card Fraud

Payment Cards (Debit, Credit and Prepaid) have raised the levels of convenience for customers. However, the convenience also comes with a high potential for fraud and funds theft during transactions.

Clari5 Payment Card Fraud Management is a comprehensive solution that combats card fraud in real-time. It provides the payment instrument issuer, payment processor or the merchant acquirer the necessary arsenal to monitor, detect and prevent all card frauds including Card-Not-Present (CNP) situations.

Download Payment Card Fraud Management Brochure

- Profiling customer behaviour based on multiple scenarios

- Merchant/ POS/ Operator Behaviour Profiling

- Real-time fraud risk advice that allows, declines or challenges a transaction

- Integrated Case Management for fraud analysts

- Comprehensive Reporting & Business Intelligence

- Immunity against third party & operator level frauds

- Reduced reputational loss due to internal/external fraud

- Better regulatory compliance & auditing

- Increased customer loyalty and advocacy

Multi-Channel Fraud

Cross-channel frauds pose the biggest threat to banks that use traditional silo-based fraud management systems. Countering cross-channel frauds requires a holistic view of the entire ecosystem, take the multiple entities into account, and cross pollinate relevant information in real-time across all products and channels.

Clari5 Cross-channel Fraud Management is a complete solution that uses intelligent models based on neutral networks, time series and complex analytics to proactively combat cross-channel/cross-product fraud. Clari5 combats frauds across velocity, internal & threshold types.

Download Multi-channel Fraud Management Brochure

- Tracks Cross-Channel and Cross Product patterns in real-time and cross pollinates the information for better decisions

- Tracks not just the channel where the fraud terminates but also the originating channel to deliver holistic fraud monitoring

- Provides comprehensive functionality with pre-packaged channel, products and geography specific scenarios

- Powerful monitoring engine functioning in absolute real-time

- Easy configuration of scenario parameters based on internal policies during deployment/run time using Clari5’s Scenario Authoring Tool (SAT)

- Enhanced fraud management capability across multiple products & channels

- Drastically reduced instances of false positives

- Reduced cross-channel fraudulent events

- Reduced reputational loss due to fraud

- Enhanced customer advocacy & loyalty

How can Clari5 help my bank?

Schedule a Demo

Schedule a 1:1 discovery demo call with our senior product experts to see how Clari5 works and have all your questions answered!