Increasing Importance of Big Data in Banking:

The phrase big data has become a buzz word. Everyone talks about it or has information in bits and pieces, but only few companies know how to utilize the same. Big data is characterized by the tremendous volumes, varieties and velocities of data, that are generated by a wide array of sources, customers, partners and regulators (IBM)

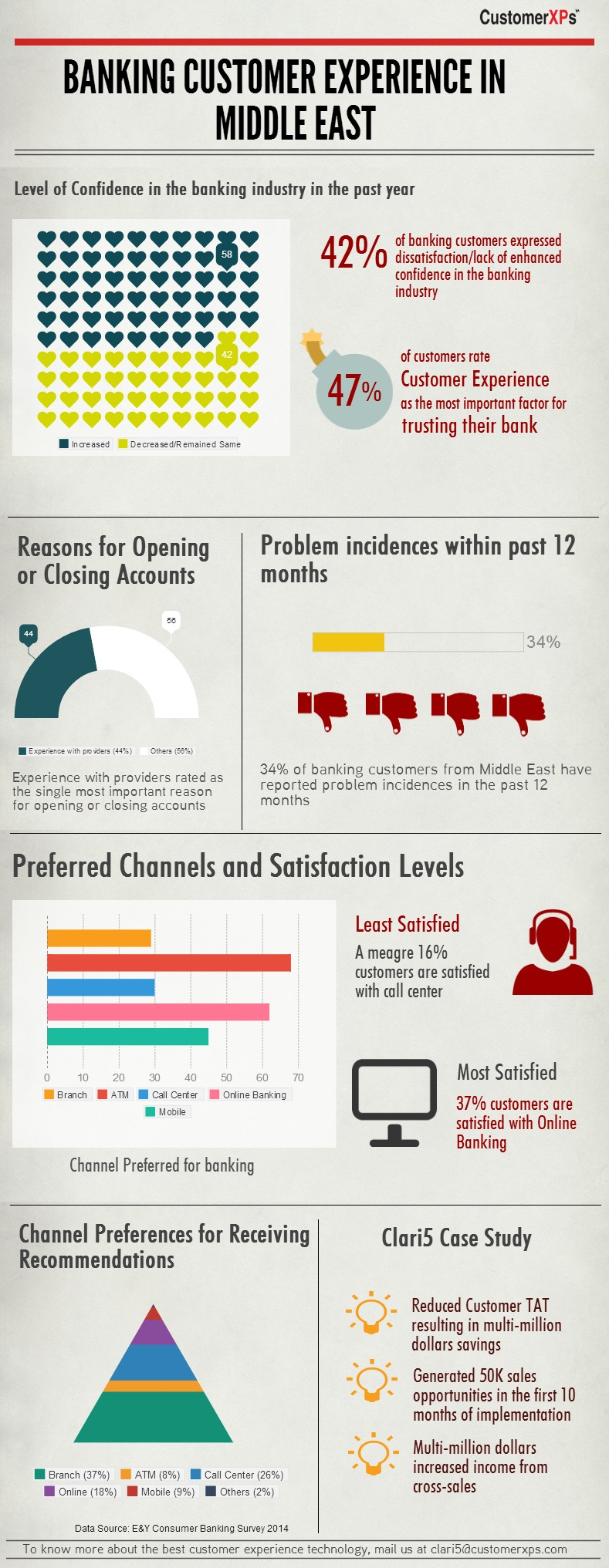

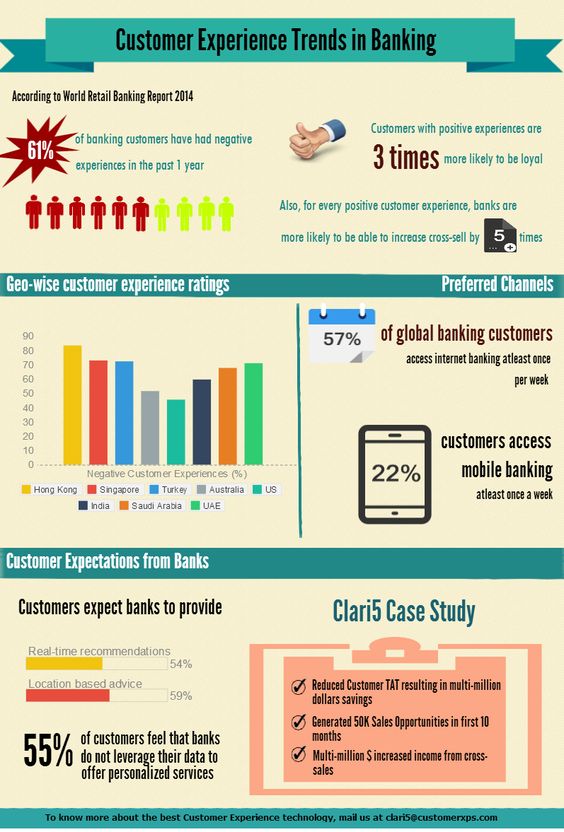

Banking is among many industries which has a vast and useful data about their customers. But right now, only a handful of banks are utilizing this pool of information and taking steps to enhance Customer Experience and deducing the data to combat fraud. Banks are aware of the fact that if the data is used smartly they will be able to cater to the needs of customers accurately.

As per research from (Capgemini) only 37% of customers believe that banks understand their needs and preferences. Banks have an abundance of informative data, but the major challenges they are facing today is how to utilize it intelligently, shortage of skilled people, insufficient tools, time constraints, the high cost associated, unstructured vast data and much more.

Most of the banks have silo based solutions to harness this pool of information. (Capgemini) research shows that organizational silos are the single biggest barrier to success with big data. Banks should apply 360 degree approach and understand the customers’ needs and act accordingly.

Big data can do wonders for banks if mined properly. Big data help to limit customer attrition, help in relationship management, increase in ROI and reducing fraud. Big data can be utilized to:

- Increase revenues by optimizing offers according to the customers’ needs

- Cross sell & up sell to the customers based on the information deduced from big data

- Reverse attrition & meets stringent regulatory requirements

- Establish more meaningful customer relationships

- Generate more personalized multichannel customer journeys

- Detect and prevent fraud by using data analytics

- Understand the behavior of their customers

- Mine new revenue streams

- Manage risk and take precautionary actions

- Understand crime and help to predict where crime is likely to occur

Big data is being increasingly used and studied by banks now. Banks have understood the potential of big data and are taking measures to apply it. Banks should come out of their silo based legacy solution to more wider and useful approach that will not only enhance customer experience, but also will help them to increase ROI, prevent fraud and reduce attrition rate.