Business intelligence (BI) solutions are not new to banking. With a blend of tools, techniques, and technology, BI processes information with accuracy, which otherwise would have been performed by humans. BI solutions have been enabling banks with capabilities to generate more revenue, reduce costs, mitigate risks, and more.

Driven by changing business models, disruptive technologies, compliance pressures, and new competition from fintechs, banking and financial services is undergoing a radical shift including the way they are using BI.

The adoption of BI applications in banking has helped improve efficiencies while lowering operational costs. Despite BI having come a long way, the challenges of data silos, security concerns and compliance have remained.

Sustainable success in business demands real-time insights, agility, exponentially growing customer relationships, and continuous innovation. Banks today need to be able to leverage the agility and scalability of contemporary technology innovations to stay ahead of the game.

BI and AI are distinct but complementary. The ‘intelligence’ in AI refers to computer intelligence, while in BI it refers to the more intelligent business decision-making that data analysis and visualization can provide. BI helps banks put the proverbial ‘method in the madness’ to the massive amounts of data they collect. But banks need more than smart visualizations and dashboards in this day and age.

Interestingly, AI and BI have significant, and in certain cases, complementary enterprise applications.

AI can enable BI tools to deliver clear, useful insights from the data they analyze. An AI-powered BI system can clarify the importance of each datapoint at a granular level, and help human operators understand how that data can translate into real business decisions. With the convergence of AI and BI, banks can synthesize vast quantities of data into synchronized action plans.

AI Transforming Decision-Making

AI-based BI tools are simpler to use, deliver more useful insights, and make business users more productive, saving substantial time and money. More than just provide superficial insights, AI-based solutions recommend ways to fix issues, run simulations to optimize processes, create new performance targets based on forecasts, and take action automatically

AI is making a substantial difference in analytics by democratizing data and improving adoption. With their extraordinary ability to adapt and learn, AI-powered solutions deliver better real-time insights and feedback data.

Core AI applications such as predictive analytics and ML have opened the doors to a whole new generation of applications. Since AI can analyze massive quantities of data and deliver instant recommendations, a fundamental shift is already occurring, and its impact is evident across industries especially banking and financial services.

Insights are now much more accessible and comprehensible to the average user, and with such an upgrade, they can assist business in reconsidering their strategies.

Banks and AI – where are we today?

Today most banks and credit unions are only beginning to use AI. Over 30% of financial services use AI technologies such as predictive analytics, recommendation engines, voice recognition and response. The most ubiquitous form of AI is chatbots that are actively used in the front office. The top areas using AI remain cards and payments.

A recent analysis of very select ivy league banks in the US revealed that AI is being used in complex, repetitive processes and data analysis. A leading global bank recently launched a contract intelligence platform for analyzing legal documents and extracting important data points and clauses.

Their ML technology enables analyzing thousands of commercial agreements in a few seconds. This means a dramatic reduction in the time spent on manual back-end processes.

Another leading US bank adopted AI for its intelligent virtual assistant, which uses predictive analytics and cognitive messaging to provide financial guidance to their 45 million+ customers.

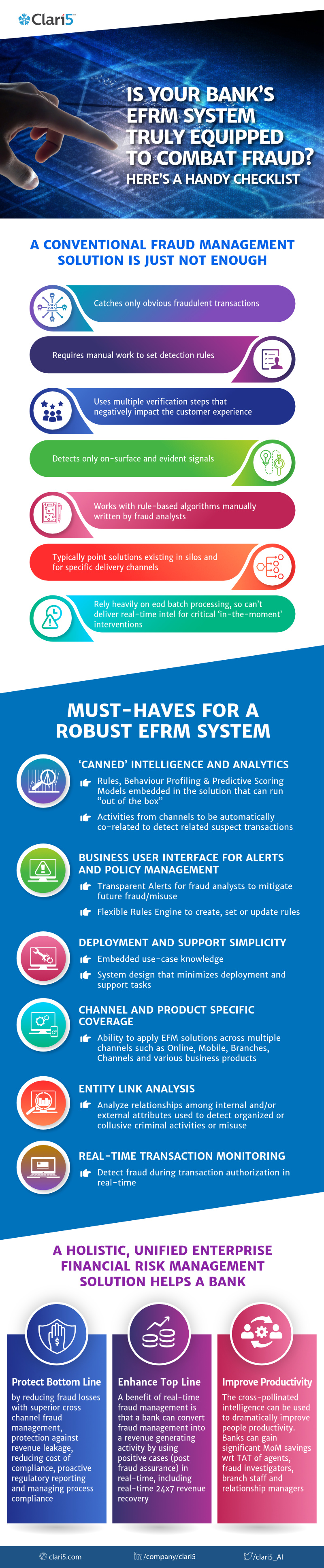

Yet another business-critical application of AI in banking is fraud identification and prevention. With the average loss to fraud attacks at 1.5% of their annual revenue, one of the most important application of AI in financial services is risk management,

A leading global US bank partners with tech companies to improve its services and stay in the forefront. One of its strategic investments is using ML to evaluate “big data” and potentially fraudulent activities in all avenues of commerce including online and offline banking.

AI Reshaping Risk Management

AI has turned out to be a game changer for fraud risk management in finance as it provides banks and credit unions with the necessary tools and solutions to identify potential risks and fraud.

The financial crisis of the previous decade gave financial services firms a lot of problems with credit challenged consumers.

Before the digital revolution in the financial services industry, customer intelligence was based on some relatively simple heuristics, the customer value data was gained via focus groups and surveys of consumer behavior – results of which didn’t necessarily convey reality.

Today new technologies provide banks access to vast amounts of data about consumers’ behavior and needs.

Another great source of problems for banks is online lending technology and the emergence of alternative lenders. Non-traditional lenders use technology-based algorithms and software integrations to assess credit profiles of customers and are also leveraging alternative data such as social media photos and check-ins, GPS data, e-commerce and online purchases, mobile data, and bill payments.

Risk management in banks must use cognitive technologies to gain competitive advantage and use risk to power their organizations’ performance.

AI in Financial Crime Risk Management

Given the development of digital technologies and shrinking costs of data storage, AI is now becoming an integral part of business processes. ML allows managing and analyzing unstructured data, saving time and money of financial services companies.

AI in banking risk management lowers operational, regulatory and compliance costs and provide reliable credit scorings for credit decision makers. Risk assessment AI can provide a fast and accurate risk assessment, using both financial and non-financial data to factor in the character and capacity of a customer.

AI-powered risk management solutions are also used for model risk management (back-testing and model validation) and stress testing, a key requirement by European and US regulators.

AI-based Risk Management in Banking – What Are The Challenges?

Besides the technical challenges of developing AI apps for banking, e.g. building correct and relevant algorithms, there are also challenges related to regulatory field and data access rights.

The fintech ecosystem is governed by strict compliance to regulations related to data. Data breaches can be expensive and new legislations, e.g. GDPR in EU, provisions for serious liability for companies dealing with personal data. Also, there are several regulations governing financial institutions in the US and Europe, e.g. FINRA, MiFID and EMIR.

The ability of ML models to analyze large amounts of data – both structured and unstructured – can improve analytical capabilities in risk management and compliance, allowing risk managers in financial institutions to identify risks in an effective and timely manner, make more informed decisions, and make banking less risky.

AI and risk management dovetail well when banks need to manage unstructured data. Risk managers must focus on analytics and stopping losses in a proactive manner based on AI findings, instead of spending time managing the risks inherent in the operational processes.

Moving from ‘What happened?’ to ‘What’ll happen next?

With unimaginable volumes of data generated each day via millions of transactions, banking is quite easily one of the most data-intensive sectors. The volume of data generated will only swell further, also due to the proliferation of newer technologies.

Banking in the BI age used insights to understand customer behavior, make financial forecasts, analyze operational performance efficiencies, and create reports for regulatory compliance. BI has now begun adopting features and capabilities that blend machine learning with conventional BI offerings.

With open banking and digital transformation having completely changed the game for financial services, it is imperative to monetize value from a continuously changing environment, and do it real fast.

The future of BI is beginning to be powered by AI. There are numerous applications of AI in the financial services ecosystem that help identify patterns and connections in real-time that humans cannot, thus opening the doors to newer possibilities to gain better customer intel, boost growth, and combat fraud.

Regardless of certain valid differences, AI-led BI is a force multiplier. Rather than view AI and BI as disparate technologies, banks must invest in realizing the combined potential that will only help them grow to newer heights.

References

As Chartis Research had highlighted in their previous iteration of this report, the landscape for enterprise fraud is increasingly dividing into 2 distinct areas: account-based fraud and payments-based fraud.

As Chartis Research had highlighted in their previous iteration of this report, the landscape for enterprise fraud is increasingly dividing into 2 distinct areas: account-based fraud and payments-based fraud.