The report studies the global Financial Fraud Detection Software market, analyzes and researches the Financial Fraud Detection Software development status and forecast in United States, EU, Japan, China, India and Southeast Asia. The report focuses on the top players in the global market, including CustomerXPs. Download the complete report.

The report studies the global Financial Fraud Detection Software market, analyzes and researches the Financial Fraud Detection Software development status and forecast in United States, EU, Japan, China, India and Southeast Asia. The report focuses on the top players in the global market, including CustomerXPs. Download the complete report.

Month: April 2018

May 2018 Issue

Augmenting Financial Inclusion Efforts Efficacy in Sub-Saharan Africa

Augmenting Financial Inclusion Efforts Efficacy in Sub-Saharan Africa

Financial inclusion plays a vital role in socio-economic development particularly in developing economies. While nations in sub-Saharan Africa have been investing substantial efforts to make financial services available to the underprivileged and marginalised, a vast majority still use informal modes to pay, save and lend.

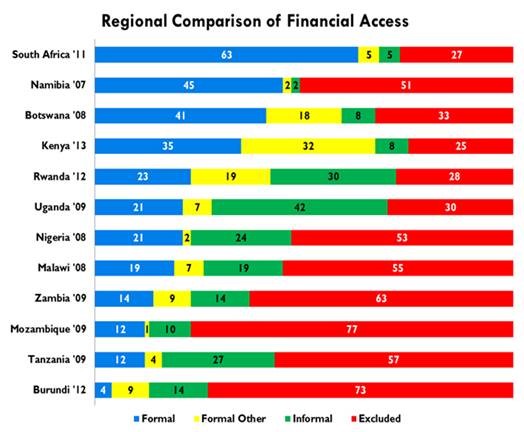

Incidentally, Africa has the lowest account penetration with sub-Saharan Africa at 24%, and the Middle East and North Africa at 18%. Only 22% of enterprises in sub-Saharan Africa have a loan or a line of credit compared to an average of 43% in other developing regions.

The central banks of Kenya, Nigeria, Tanzania and Uganda are mandated to supervise the banking system in their respective countries. The Central Bank of Kenya states that there have been significant strides in increasing the outreach of financial services in the last five years.

Some of these include enhanced risk management and supervisory standards and practices; decline of the financial sector entry barriers and cost of maintaining accounts resulting in increased number of deposit and loan accounts; introduction of innovative financial service instruments and delivery channels; and notable increase in penetration of financial services.

Tanzania has seen an increase in the number of commercial banks and NBFCs, making it a highly competitive environment for financial services. This in turn has also led to an increase in the introduction and innovation of new financial products and services.

However deeper and wider penetration of financial inclusion initiatives (to include more unbanked and underbanked citizens) continues to be a challenge in sub-Saharan Africa. Also, traditional banking models are fast becoming economically unviable. Reach and conversion efforts are also hampered by inadequate financial infrastructure and financial illiteracy.

M-Banking Fueling Financial Inclusion Efforts

In the past ineffectual implementation of financial inclusion programs impacted the last-mile delivery of financial services to the target beneficiaries. But with mobile banking providing substantially wider reach and opening up new transaction channels, it offers exciting new opportunities for partnerships between banks and NBFCs.

With the African mobile user footprint growing rapidly, second only to Asia (the GSMA Report on Africa estimates that out of approx. 1 billion Africans, nearly 735 million are mobile phone subscribers), mobile banking holds substantial promise for sub-Saharan African nations to widen the reach and efficacy of financial inclusion programs.

Mobile Network Operators or MNOs are rapidly becoming the preferred choice for banking across Kenya, Tanzania and Uganda as they are able to reach areas where conventional banks are absent. MNOs provide subscribers with a wide spectrum of choices from opening new accounts to checking balances to bill payments to money transfer and basic e-commerce.

M-Pesa, the most well-known of Africa’s mobile money services, now has more than 30 million active users in 10 countries, who use their smartphones to make international as well as domestic account transfers, and to make and take loans, and receive health benefits.

Mobile banking is now the default mode of financial transactions in most sub-Saharan African nations. Also, M-banking is 19% cheaper when compared with traditional banks and 54% cheaper when compared with informal options.

However, the exponential growth of M-banking has also brought financial crime into the spotlight. Effectively tackling financial crime, especially in developing nations, demands intelligent defence mechanisms. MNOs and banks must shield themselves and their customers with preventive measures that are not restricted to M-banking alone.

Adding a Fourth Dimension

The international AML (anti-money laundering) and fraud prevention agency, the Financial Action Task Force is working closely with the Central Banks in SSA to set standards for AML and CFT (combating the finance of terrorism). Given increased incidents of AML/ CFT threats and attacks, banks and mobile financial service providers are mandated to adhere to CDD (Customer Due Diligence) and KYC (Know Your Customer).

For investors, customers and financial service providers, security of transactions and providing protection against fraud is the difference between growth and failure. Investors grade regions by the level of risk involved with their investments. They are as keen as policy framers and the governments of these nations for an expanded financial inclusion universe. But as an investor notes: “Lack of data both at the sector level and at the client level is an important obstacle.”

Today, a number of banks in sub-Saharan countries are building large-scale mobile money operations as independent payment service providers. Microfinance institutions have also begun leveraging technology and distribution to expand their footprints. As these systems evolve, it also increases susceptibility to financial crime. Banks, MNOs, non-banking financial companies and microfinance institutions in the region must all proactively explore solutions that are engineered to counter sophisticated threats.

They have been enforcing CDD and KYC rules to address some of these issues. But efforts have been siloed and reactive to a large extent. They can re-evaluate their enterprise fraud risk management strategy and explore innovative solutions that not only help combat fraud but also help grow revenue simultaneously. Intelligent real-time, cross-channel solutions actually help detect and prevent fraud while also using the same contextual insights for customer cross sell and upsell.

For a region that has begun experiencing the transformational benefits of financial inclusion initiatives, it would augur well for the constituent financial services institutions and regulators to add the vital fourth dimension i.e security, to the existing three – of access, affordability, quality.