AI-powered ‘Gen-centric’ Banking

With increasing diversity in the banking customers’ age groups, needs, values, priorities and perspectives, banks interact with several ‘generations’ of customers. Multigeneration banking evolved from

Providing a Frictionless and Secure Customer Journey in PSD2

European leaders have long identified that the future of the financial services lies in the co-existence of the conventional banks with emerging fintech. However, to

Customer Liability in The Age of Digital Banking

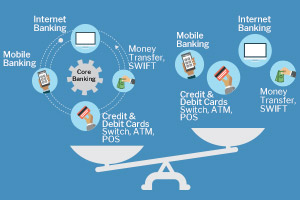

Today, in India, when a customer discovers and reports fraud in his account through the use of ATM, Internet Banking or Mobile Banking, customer is liable for the full funds lost. As of Feb 2011, Indian Banking industry has 70,462 ATMs and 5,65,542 POS terminals. The value of debit card POS transaction from Mar 2010-Feb 2011 was 75,326 crores and the value of debit card ATM transaction during the same period was 10,90,053 crores. The size of credit card POS transaction was 75,328 crores. (Source: RBI). Given this huge volumes of electronic transactions in India banking, the value at risk for banks would be humungous when the customer zero liability protection policy gets introduced. It’s high time the banks secure their electronic channels with adequate measures to monitor, detect and prevent fraud in real-time. Read on..

New Department: Financial Crimes Department

If you have ever shopped on Amazon.com or ordered a movie on Netflix, you most likely have experienced “Predictive Analytics”. The accuracy and the speed

Asia’s Growing Financial Crime – Shielding from the Growing Threat

‘Attempted heist of $1 billion by unidentified hackers’ the shot rang out across the financial world which experienced first-hand the tremors of cybercrime. The yet

Are banks using customers’ ‘Situational Intelligence’ for effective real-time fraud protection?

How can you make your bank’s customers control transactions on their accounts and use it as an effective fraud protection mechanism? Customer communication and preferences

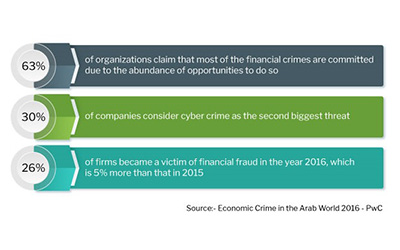

Defending Against Financial Crime in MENA: Insights & Recommendations

Alarming revelations on money laundering and banking frauds have emerged in recent reports by Deloitte, Thomson Reuters and PwC, who comprehensively surveyed MENA (Middle East

Episode 4: Money Rolls

Our new series of thrillers – produced and directed by CustomerXPs and Banking Technology – narrate the tales of the fight between the forces of good (the Clari5 analytics and anti-fraud software) and the forces of evil. Based on real events and guaranteed to keep you on the edge of your seat!

The Power of ‘Segment of 1’

Read how the theoretical concept of ‘the segment of 1’ can be practically applied in real-time for fighting fraud as well as maximizing customer revenues

How To Monetize your Anti-Fraud Solution to Make Money for your Bank

How To Monetize your Anti-Fraud Solution to Make Money for your BankHow To Monetize your Anti-Fraud Solution to Make Money for your Bank. Read More

‘Money Rolls’

‘Money Rolls’The next episode in the financial fraud thriller series based on Clari5 product use-case scenarios, co-produced and directed along with Banking Technology magazine. Read the previous episodes – Read More

Ep 3: Inside Job

Ep 2: Blacklisted

Ep 1: Malafide Intentions

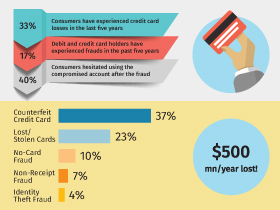

Infographic: Credit Card Frauds 101

Infographic: Credit Card Frauds 101 Clari5 Case Study: Real-time AML for Prominent Bank

Clari5 Case Study: Real-time AML for Prominent Bank| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |