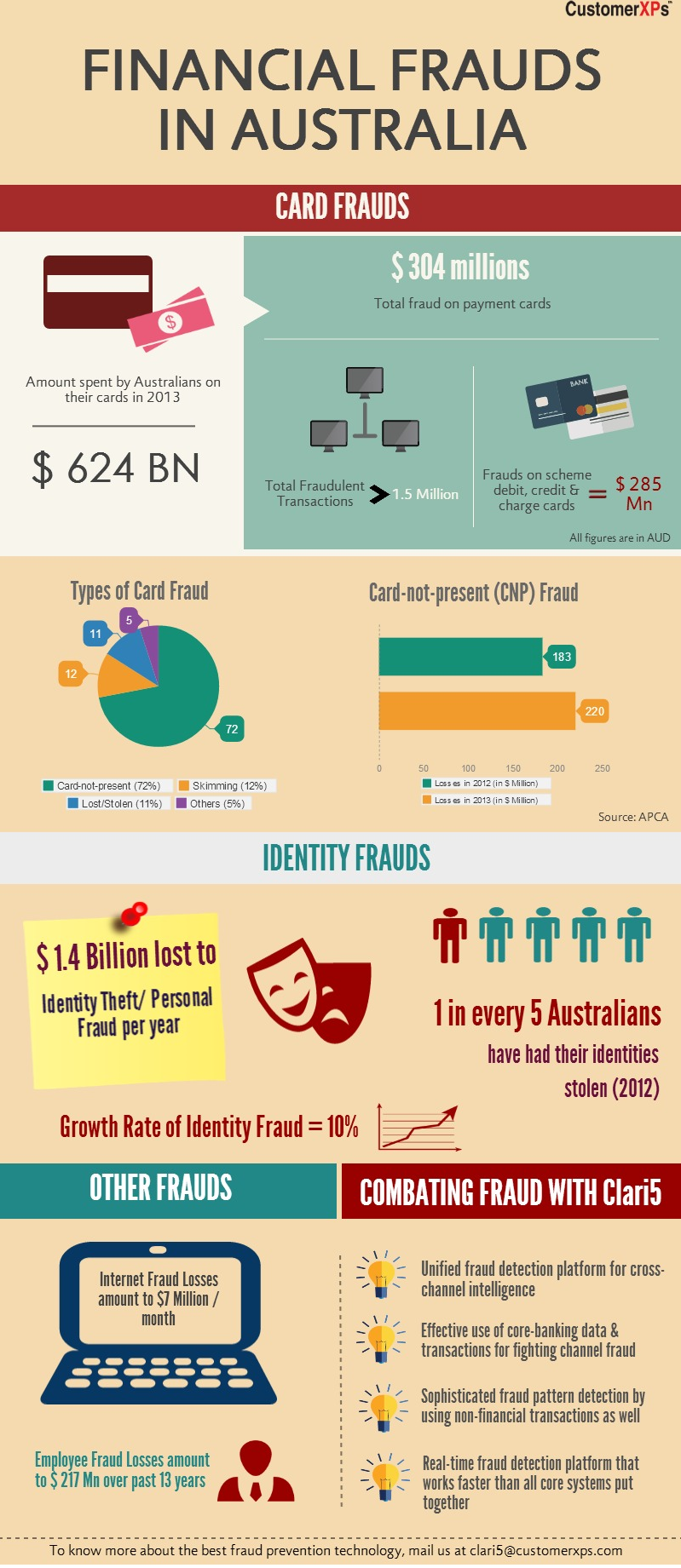

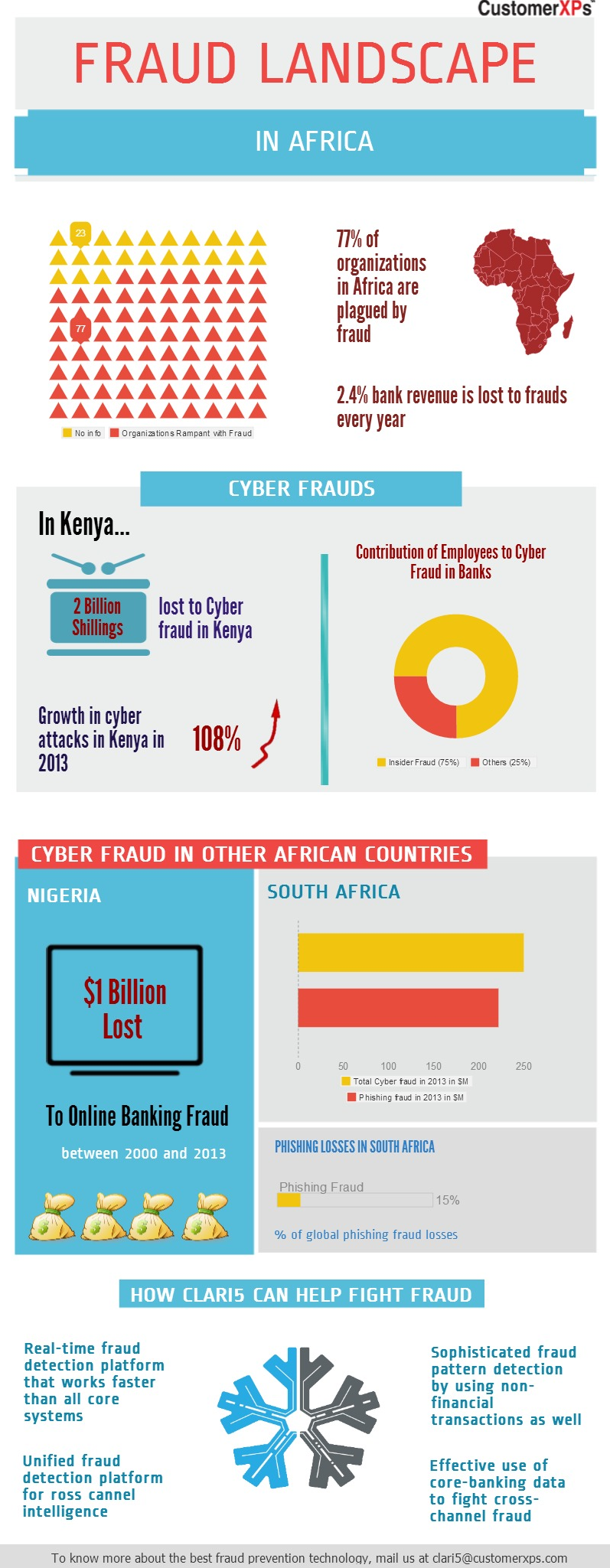

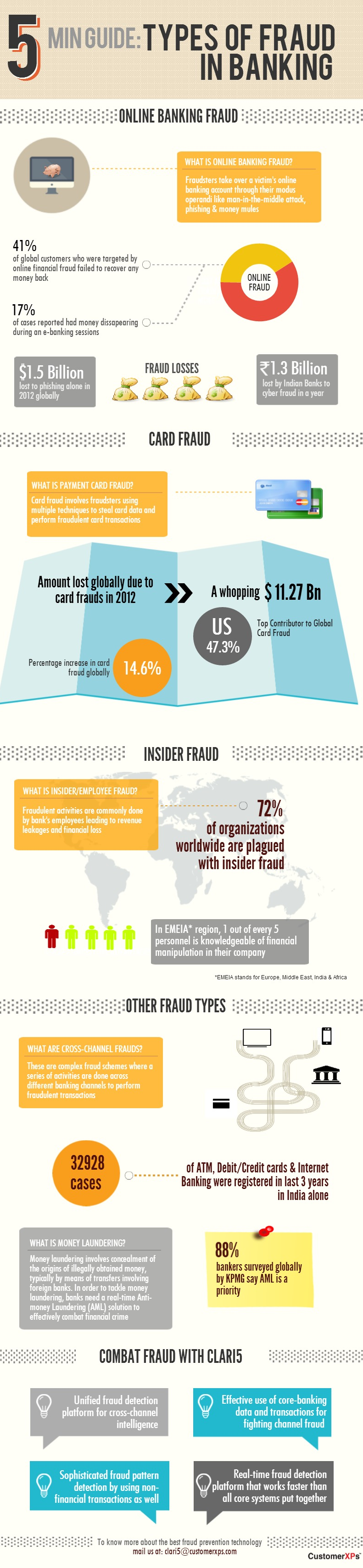

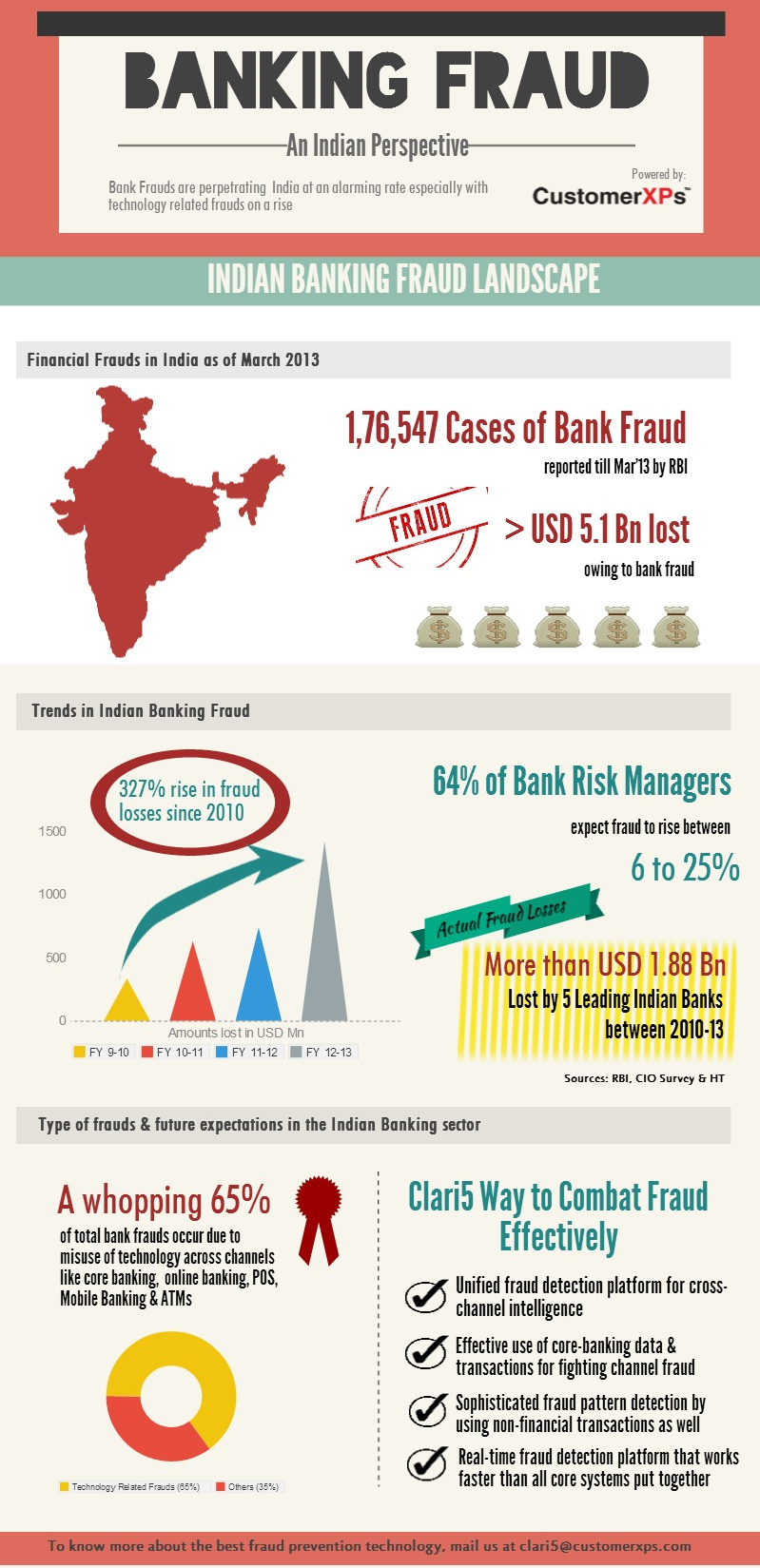

Financial Crime in South Africa is overwhelmingly omnipresent. According to Christopher Malan, Head of Financial Intelligence Center, South African banks have to work towards being more compliant in combating financial crime i.e. Terrorism Financing and Money Laundering.

Four big banks of South Africa were fined for R125 million by the Reserve Bank for failing being compliant to the regulations. Banks are highly criticized for forming cartels, and behaving monopolistically in the African region. This is one of the various reasons for high financial crime rate in South Africa.

According to PWC report, the biggest thieves are not the lowest paid or least educated but was quite opposite. The senior management are the main perpetrators in South Africa. The fraudsters are mainly in their thirties with University degrees.

The most common scams prevailing in South Africa are internal fraud, money laundering, e-mail scams, identity theft, remittance scams, bribing and corruption, and misappropriation of assets. The leading scam among all the above list is the internal fraud. This revelations by PWC has built a cloud of uncertainty and mistrust inside the organisation. This has shattered the trust of customers on the financial organization.

Financial crime in South Africa has taken its toll on the lives of people. It has directly or indirectly affected the livelihood of people. Frauds and Scams have robbed people of their resources. It has drained the funds available for country’s development. By knowing what to look out for, one can avoid falling victim to common fraud and scams. Hence, the following infographics will give an overview of different prevailing scams in South Africa. I hope you find it useful.