Newsroom

Read the latest about Clari5 in the news and media coverage featuring Clari5’s unique approach to fighting financial crime.

Interview | Banks Need Living Fraud Defenses for Living Threats

Balaji Suryanarayana’s interview with IBS Intelligence FinTech Journal

Financial crime is mutating into a real-time, shape-shifting threat, leaving traditional defenses struggling to keep pace. In an in-depth interview with IBS Intelligence FinTech Journal, Clari5 COO Balaji Suryanarayana explains why banks must move beyond static controls to embrace living fraud defense systems that breathe, think, and adapt continuously as fraud evolves.

He highlights the need for contextual intelligence at the core of fraud investigations, rather than isolated alerts, and stresses how embedded prevention within banking infrastructure is key to resilience. Balaji also discusses how banks can strengthen defenses against emerging risks, from deepfake identities and mule accounts to sophisticated social engineering schemes.

Key Takeaways

- Fraud investigations must start with contextual intelligence, not isolated alerts.

- Defenses must evolve to counter new-age threats such as deepfakes, mule accounts, and social engineering.

- Fraud prevention must be embedded into the very fabric of banking infrastructure.

- Continuous, adaptive systems, not one-time controls, will define the future of fraud defense.

Podcast | Banking on a ‘Living’ Anti-Fraud Operating System

Rivi Varghese in conversation with IBS Intelligence

Fraud mutates daily and often faster than banks can respond. In an insightful podcast with Robin Amlôt, Managing Editor at IBS Intelligence, Clari5 CEO Rivi Varghese explains why static, rules-based defenses fall short and why banks need a Living Anti-Fraud Operating System (OS) at the core of their strategy.

Rivi highlights how AI-driven fraudsters can evolve attack patterns in hours, leaving traditional, static defenses ineffective. He introduces the concept of a “living” anti-fraud OS, an intelligent, adaptive system that learns, evolves, and grows stronger with every new threat by harnessing collective intelligence across the banking ecosystem.

Key Takeaways

- Fraud is a living problem. Dead tools cannot stop it.

- Collective immunity matters. One bank’s detection can protect all.

- Trust is the ultimate differentiator. Security and seamlessness must go together.

- Investigators are empowered, not replaced. Living systems free experts to focus on complex fraud.

- Boardroom priority. In the era of instant payments and AI-powered fraud, trust infrastructure must anchor digital banking.

Listen to the full podcast on

Clari5 Recognized Among Top FinTech Software Development Companies in 2025 by Techreviewer.co

Clari5 has been named one of the top FinTech software development companies of 2025 by Techreviewer.co, a recognition that underscores our unwavering commitment to delivering cutting-edge fraud prevention and revenue growth solutions to the global banking industry.

This prestigious recognition comes at a pivotal time for our company, as we continue to expand our reach across 24 countries while serving millions of accounts and processing billions of transactions through our advanced real-time central nervous system. The acknowledgment from Techreviewer.co validates our years of dedicated work in the fraud prevention space and reinforces our position as a category-leading solution provider.

Driving Innovation in Financial Technology

Our inclusion in this elite list reflects the innovative approach we have taken to address one of the most critical challenges facing modern financial institutions: balancing robust fraud prevention with seamless revenue growth. We have developed a comprehensive cross-channel platform that provides banks with 360-degree insights across all their operational channels, enabling them to make informed decisions in real-time while maintaining the highest levels of security.

The recognition acknowledges our ability to serve institutions of all sizes, from community banks to large-scale operations managing millions of accounts at a single site. Our robust system architecture is designed to auto-scale as banks grow, ensuring that our clients never outgrow our capabilities regardless of their expansion trajectory.

Proven Track Record of Excellence

Years of fighting fraud have provided us with deep insights into the evolving landscape of financial threats and opportunities. Our experience processing billions of transactions has enabled us to refine our algorithms and enhance our predictive capabilities, resulting in a solution that not only prevents fraud but actively contributes to revenue generation.

We have consistently demonstrated our ability to protect billions of user accounts while maintaining the agility and responsiveness that modern banking demands. This balance between security and performance has been instrumental in establishing our reputation as a trusted partner for financial institutions worldwide.

Comprehensive Cross-Channel Protection

What sets our platform apart is its comprehensive approach to fraud prevention and revenue optimization. Rather than focusing on isolated channels or single points of vulnerability, we provide a unified view across all customer touchpoints. This holistic perspective enables banks to identify patterns and anomalies that might otherwise go undetected, while simultaneously uncovering opportunities for revenue growth.

Our real-time processing capabilities ensure that decisions are made instantly, without compromising the customer experience or creating unnecessary friction in legitimate transactions. This real-time approach is particularly crucial in today’s fast-paced financial environment, where delays can result in lost opportunities or successful fraudulent attacks.

Global Reach and Local Expertise

Our presence in 24 countries has provided us with valuable insights into regional fraud patterns, regulatory requirements, and market dynamics. This global perspective, combined with our deep technical expertise, enables us to deliver solutions that are both universally applicable and locally relevant.

We have built our reputation on understanding that each market has unique characteristics and challenges. Our platform is designed to adapt to these variations while maintaining consistent performance standards across all deployments.

Looking Forward

“This recognition from Techreviewer.co motivates us to continue pushing the boundaries of what’s possible in FinTech software development. We remain committed to innovation and excellence as we work to help our banking partners navigate an increasingly complex landscape of threats and opportunities.

We will continue to invest in research and development, ensuring that our platform evolves alongside emerging technologies and threat vectors. Our goal remains unchanged: to provide banks with the tools they need to grow their revenue while maintaining the highest levels of security and compliance”, Rivi Varghese, Founder & Chairman, Clari5.

About Techreviewer.co

Techreviewer.co is a comprehensive technology review platform that evaluates and ranks software development companies across various industries. The platform conducts thorough assessments based on technical expertise, client satisfaction, innovation, and market impact. Their annual rankings serve as valuable resources for businesses seeking reliable technology partners and provide recognition for companies demonstrating excellence in their respective fields.

Perfios Announces Strategic Acquisition Clari5

Perfios, India’s largest B2B SaaS TechFin, today announced the strategic acquisition of Clari5 (CustomerXPs), a category leader in banking financial crime management. Clari5’s real-time platform empowers banks to detect, investigate, and prevent fraud. Its product suite encompasses three critical areas, i.e. fraud mitigation, risk management, and anti-money laundering (AML).

Perfios, India’s largest B2B SaaS TechFin, today announced the strategic acquisition of Clari5 (CustomerXPs), a category leader in banking financial crime management. Clari5’s real-time platform empowers banks to detect, investigate, and prevent fraud. Its product suite encompasses three critical areas, i.e. fraud mitigation, risk management, and anti-money laundering (AML).

The strategic acquisition further strengthens Perfios’ fraud and risk management (FRM) capabilities, driving product-led synergies that will fuel the company’s aggressive growth trajectory. This move solidifies Perfios’ leadership in the financial sector in its home market, India, while also strengthening its presence across its key global markets, including the Middle East, North Africa (MENA), and Southeast Asia (SEA).

Commenting on the development, Sabyasachi Goswami, CEO, Perfios said, “We are thrilled to welcome Clari5 into the Perfios family. The acquisition of Clari5, a leader in EFRM & AML, marks a significant milestone in our journey to build the most comprehensive fraud and risk management ecosystem.” He added, “Clari5’s real-time financial crime management platform, trusted by marquee financial institutions worldwide, perfectly complements Perfios’ mission to deliver secure, scalable, and tech-first solutions. Together, we are set to redefine fraud prevention, risk intelligence, and AML compliance, empowering financial institutions to stay ahead of evolving threats while powering financial security to billions across the globe.”

Rivi Varghese, Founder & Chairman, Clari5, said, “Joining forces with Perfios marks a new chapter of growth and innovation for Clari5. With Perfios’ deep expertise in the financial technology ecosystem and our advanced real-time financial crime management platform, we are creating a powerful synergy to redefine fraud prevention, risk intelligence, and AML compliance at scale. This partnership enables us to expand our reach, accelerate product innovation, and strengthen our ability to help financial institutions combat evolving financial crime with unmatched speed and precision. Perfios’ scale, global presence, and stability position us to serve the largest banks worldwide, enabling us to deliver impactful solutions to financial institutions of all sizes and complexities.

About Clari5:

Clari5 is a category-leading innovator in banking financial crime management, empowering mission-driven banks to combat the global $4 trillion fraud challenge. Trusted by marquee banks worldwide, Clari5 processes over 10 billion transactions monthly, manages more than 1 billion accounts, and serves customers across 15 countries. With 340 million+ accounts at a single site, Clari5 has powered some of the largest fraud management deployments globally.

About Perfios:

Founded in 2008, Perfios is a global B2B SaaS company serving the Banking, Financial Services and Insurance industry in 18 countries, empowering 1000+ financial institutions. Through their pioneering software platforms and products, Perfios helps financial institutions to take big leaps by shaping their origination, onboarding, decisioning, underwriting and monitoring processes at scale and speed. Perfios delivers 8.2 billion data points to banks and financial institutions every year to facilitate faster decisioning, and significantly accelerates access to credit and financial services for their clients’ customers. Headquartered in Bangalore, Perfios offers a comprehensive suite of 75+ products and platforms, providing clients with a robust, end-to-end technology backbone they can rely on.

To know more, visit Perfios.com and follow them on LinkedIn, Facebook, Instagram, YouTube.

Media Contact:

Head of Communications:

Garima Kaul

+91 93158 35850

garima.kaul@perfios.com

PNB Becomes the First Bank to Go Live with Clari5’s Cutting-Edge, Real-Time NCRP Integration Solution!

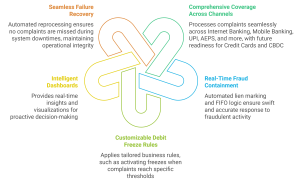

In a landmark achievement, Punjab National Bank (PNB) has become the first bank in India to go live with Clari5’s NCRP Integration Solution, setting a new standard in fraud prevention and complaint management. This state-of-the-art solution, built in alignment with the I4C National Cybercrime Reporting Portal (NCRP), enables automated, real-time, and end-to-end processing of complaints across all retail banking channels, marking a transformative leap for the Indian banking sector.

Key Highlights

A Milestone in Fraud Prevention

Clari5’s innovative integration solution is not just a tool but a game-changer in fraud management, empowering banks to act quickly, efficiently, and securely. PNB’s implementation of this solution is a testament to its commitment to innovation and customer security.

Rivi Varghese, CEO of Clari5, commented:

“We are truly honored to partner with PNB in achieving this groundbreaking milestone. This first-of-its-kind integration sets a benchmark for the entire banking industry, and it wouldn’t have been possible without PNB’s visionary leadership and unwavering commitment to innovation and customer security. We also extend our heartfelt thanks to I4C for their guidance and collaboration in shaping a solution that aligns with their vision for secure, real-time complaint handling. Together, we are paving the way for a safer and more secure financial ecosystem in India.”

Transforming Fraud Management for the Future

As the first movers in this space, Clari5 is proud to lead the way in delivering advanced fraud management solutions that align with I4C’s vision of a secure financial ecosystem. The success of this implementation at PNB lays a strong foundation for expanding this transformative technology across other banks in India.

For more information about the Clari5 NCRP Integration Solution or to explore how it can be deployed at your bank, please contact us at connect@customerxps.com. Together, let’s set new standards in fraud prevention.